7-Minute Read

You may be aware that the cost of college today is much higher than it was twenty years ago, and the country has a student loan crisis. Part of the problem is understanding the actual cost of your child’s college education. It is a challenge, and it’s more important than ever for you to become a better consumer of the college education product.

Among other things, it involves grasping the difference between merit-based and need-based financial aid and the likelihood of receiving either type. You also need to consider what tax credits may be available to reduce your net costs.

Different colleges have different business models and provide aid in various ways. When searching for schools, it’s essential to look beyond the sticker price and determine the actual price you will pay.

Skipping this research and making uninformed decisions can lead to problems. For instance, if your child applies and gets admitted to a college without knowing the true cost, you may only realize the financial implications months before the school semester starts.

If you, as a parent, bear the cost, consider the impact on your own financial and retirement goals. If you transfer the cost to your child through student loans, you need to assess whether the college education will yield the desired “return on investment.”

In this article, I will demystify how part of the system works. While this is real life with real consequences, understanding how to play the game can be crucial. I will address two questions:

- How do Colleges Determine Your Financial Need?

- How do you Maximize Your Financial Aid?

Read on to see some of the potentially worst financial advice I could give, which may still be worth considering for some of you!

How Do Colleges Determine Your Financial Need

How can you determine the actual out-of-pocket cost for college, whether for yourself or your college-bound child? It may seem like a trick question. Shouldn’t you just check the prices on the websites of the colleges you’re interested in? While you can certainly do that, keep in mind that there can be a significant gap between the sticker prices and the actual amount you’ll pay for college.

I believe that you will gain a deeper understanding by completing the Free Application for Federal Student Aid, also known as the FAFSA®. Most colleges require this form, although it’s important to note that a select group of colleges also require the CSS Profile. While results from the CSS Profile can differ from the FAFSA®, we’ll use the FAFSA® in this blog to help set your expectations.

It’s important to complete the FAFSA® every year for your college-bound children, even if you don’t anticipate needing financial aid. Doing so keeps federal student loan options open, and some colleges may require them for institutional scholarships.

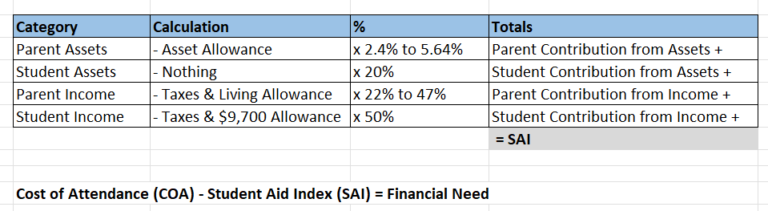

The main purpose of the FAFSA® is to determine the government’s expectation of your contribution to your children’s education. This is calculated using formulas based on parental assets, income, and the student’s resources. These formulas are summarized in the table below.

The FAFSA® SAI Formula

Because formulas are for geeks like me, I’ll clarify a few things:

- The Cost of Attendance (COA) is the total cost, including tuition, books, fees, room and board, and some additional expenses. You can find this information on the college websites.

- The Student Aid Index (SAI) is calculated using specific formulas and is subtracted from the Cost of Attendance. If there’s a difference, it means you have a financial aid need.

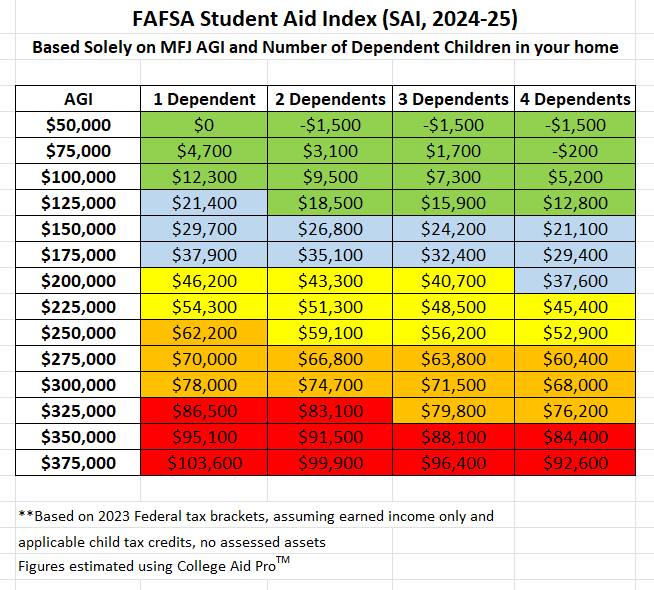

When you use these formulas, what can you expect to see? Results will differ from family to family, but in general, I believe the third row (Parent Income) is the most important. If you’re a parent of a college-bound student, your income will likely have the greatest impact on how much you can expect to pay. Now let’s look at the table below to better understand the impact.

A FAFSA® SAI Example

Disclaimer: I compiled these figures using College Aid Pro™. I made assumptions about taxation that may not exactly apply to your situation. The AGI figures are presumed to be from your 2023 tax return. These numbers should be fairly accurate in practice. If you complete the FAFSA® this year and receive significantly different results, please inform me!

An example could help. Say you are married with two children, your eldest is preparing for college, and the cost of attendance at your target school is $50,000 per year. If your household income (AGI) is $225,000 or more per year, you are considered to have no financial need. If you also have assessable assets, your income threshold could be even lower (more on that later).

The concept of financial need is relative. For instance, if your child’s target school costs $100,000 per year, your financial need under the same assumptions becomes closer to $50,000 per year. Here are a couple more generalizations:

- If your Adjusted Gross Income (AGI) is above $375,000 or you are in the red zone, you will likely have no financial need and will need to pay for all college expenses yourself, even at the most expensive universities. However, you may be able to lower your out-of-pocket costs through merit-based scholarships and tax planning strategies.

- If your AGI is under $125,000 or you are in the green zone, you should expect to have some financial need, even if you’re applying to an in-state public university.

In recent years, the FAFSA® has been simplified so that you no longer need to dig through your tax returns when completing the form. They can now import the figures directly from the IRS. But this also means there will be a lag factor when determining your financial need. If you have a child attending college in Fall 2025, they will look at your 2023 tax return. So, keep this two-year look back in mind.

One downside of the recent changes occurs if you have multiple kids in college at the same time. In the past, the equivalent of your SAI was lowered to reflect that. That favorable treatment no longer applies.

How Do You Maximize Your Financial Need?

It’s fair to ask at this point what steps you can take to increase your financial need. The straightforward answer is to reduce your assessable income or assets. However, a more pertinent question might be whether you should make any effort at all. The following strategies generally become more advisable if you anticipate being in the top half of the last table (lower AGI – green/blue shaded regions).

One – Minimize Assessable Income

On the surface, this sounds like the worst financial advice ever. For most families with college-bound students, maximizing income is important for many other reasons! I can’t think of many circumstances where I’d advise a family to stop working just to game the system.

However, if you have some control over how you can recognize income in the years before and during college, it’s worth looking at. If you’re self-employed, you may have more flexibility in managing your income. You could consider accelerating expenses instead of spreading them out. All else being equal, you’re better off having income in your own name than shifting it to your child, given how the formulas work.

If you happen to be retired during the years your kids are in college, you may have the flexibility to defer distributions from retirement accounts that would otherwise be considered assessable income.

Now, there is a way to reduce your assessable income without compromising your long-term financial well-being. A recent change to the FAFSA® allows you to benefit from making pre-tax contributions to retirement plans such as 401(k)s or Traditional IRAs.

Previously, these contributions were included in your income when determining financial need. However, now you can use retirement contributions to decrease your assessed income and work towards your long-term objectives concurrently. It’s important to note that other retirement plans for the self-employed, such as SEP IRAs and Solo 401(k)s, do not currently receive the same advantageous treatment.

Two – Minimize Assessable Assets

Ok, this might be the second worst financial advice I could give. The way the system works, you might be incentivized to minimize your assessable assets. What does that mean in practice? I don’t suggest you go on a spending spree! But I want you to consider where you’re holding your wealth. It’s easier to start with what assets are not assessed for FAFSA®.

Tip: If you’ve never put together a household balance sheet, sometimes called a net worth statement, now is a good time to do that, possibly with the help of your trusted financial planner.

Retirement accounts such as IRAs and 401(k)s are not considered assessable assets, which may make higher contributions to them more attractive. As mentioned earlier, they can also reduce assessable income if contributions are made in a pre-tax manner.

Home equity (on your primary home only) is also not considered assessable. This means there may be an incentive to pay down a mortgage if you have one. However, whether this is a good idea has other angles to consider. You can read our earlier blog on the topic: Thoughts on Paying off a Mortgage Early.

The downside of either of the strategies just mentioned is that they lower your current liquidity. This means it becomes more difficult or costly to access the money you’ve saved for retirement (e.g., early distribution penalties) or tied up in your home equity (without a home equity line of credit or cash-out refinance).

With all this said, assets that will be assessed include bank accounts, taxable investment accounts, and most college 529 plans. You can argue that the whole reason for using college 529 plans is to be more prepared to face future funding challenges. However, under the recent rule changes, you’re more incentivized to have those 529 plans owned by the grandparents of the college-bound child.

Unlike the income assessment, which is done on a two-year look back, your assets are assessed at the time you complete the FAFSA®. This means you have some flexibility to arrange transfers if that makes sense for you.

Parting Thoughts and Caveats

While I can’t delve into school selection much in this blog, lower-income households may want to prioritize colleges that offer a higher percentage of need-based aid. For instance, an elite school like Stanford covers 100% of financial need. However, it’s notoriously difficult to get into, with a 4% admittance rate at my last check.

If, after going through this entire process, you determine that you do have a financial need, don’t assume that the need will be completely covered by your desired college. You might receive an award letter that seems to cover everything, but upon closer inspection, the school might be assuming that your child will participate in a work-study program or take on some student loans. While these might be practical options to fill the funding gap, they don’t qualify as pure financial aid in the context we’re discussing in this piece.

Finally, if you’ve read this far and concluded that you won’t qualify for financial aid, there are other ways to lower college costs. You can disregard the advice in the last section about maximizing your financial needs. Your best approach will likely involve more advanced tax planning strategies or pursuing merit-based scholarships. I will cover these topics in a future blog post, so stay tuned.

If you have comments or questions on this piece, please drop me a line at: [email protected]

References

- https://studentaid.gov/h/apply-for-aid/FAFSA®

- https://cssprofile.collegeboard.org/

- https://krishnawealth.com/thoughts-on-paying-off-a-mortgage-early/

- https://krishnawealth.com/enhancing-your-college-savings-529-plan-experience/

The information on this site is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Krishna Wealth Planning LLC (referred to as “KWP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

KWP does not warrant that the information will be free from error. None of the information provided on this website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall KWP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the materials in this site, even if KWP or a KWP authorized representative has been advised of the possibility of such damages.

In no event shall KWP have any liability to you for damages, losses, and causes of action for accessing this site. Information on this website should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.