6-Minute Read

“No man is an island, entire of itself; every man is a piece of the continent, a part of the main.”

– John Donne

When you think about wealth, do you only focus on your financial capital? Typically, that is your bank, brokerage, and retirement accounts. When deciding how to invest this financial capital, you might take thoughtful steps such as projecting future cash flow, assessing risk tolerance, identifying goals, time horizons and so on.

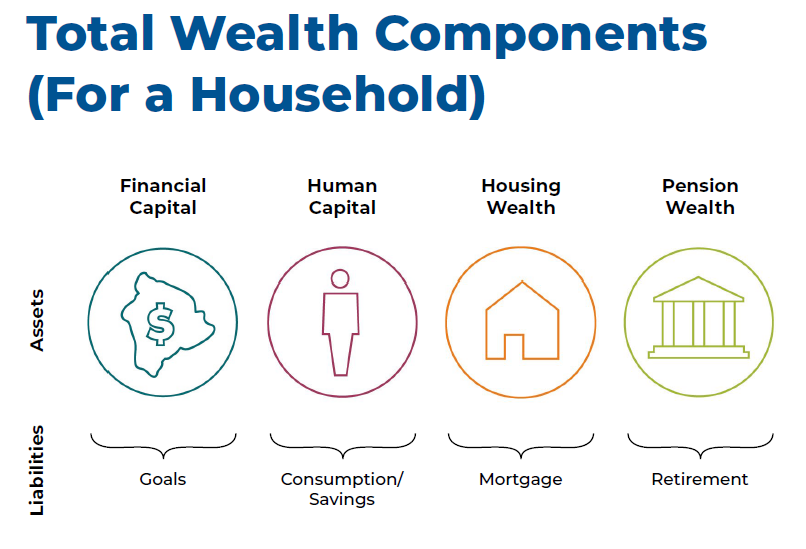

As helpful as these activities are, they may not give you the complete picture. This piece shows there are potentially three more components to your household wealth. Understanding how they function could help you make better holistic decisions in your financial and investment plans.

The Total Household Wealth Components

The inspiration for this piece comes from David Blanchett, the head of retirement research at Morningstar. He recently provided an advisor training based on earlier research called “No Portfolio Is an Island”, playing on the quote at the beginning of this piece. Here we will attempt to summarize the key takeaways from Blanchett’s research without getting deep into the math.

How we investment our financial capital cannot be viewed in isolation. We can work towards a more complete picture, and perhaps a more optimal wealth allocation, when we factor in three other pieces: Human Capital, Housing Wealth and Pension Wealth. The diagram below, courtesy of Kitces.com, shows these total wealth components.

Human Capital

Maybe the simplest way to define human capital is that it is your ability to earn income and save. So of course, it is most prevalent to those who are still working and earning. For those who are retired (and no longer plan to work), this wouldn’t apply and thus there would be more reliance on financial capital, housing, and pension wealth.

For those in the accumulation stage of wealth building and still working, human capital is often the largest asset. Interestingly, Blanchett noted that human capital represents the largest share of wealth in the economy, ranging between 60% and 95% depending on the study.

It’s a challenge to quantify the actual “risk” of human capital. Different industries and occupations have varying sensitivities to the economic cycle or presently, how they are impacted by the global pandemic. There will also be non-market, job-specific risk for any individual. Furthermore, for a given occupation, a wage employee and a self-employed contractor likely face different sets of risks and rewards.

So how do you proceed under such nuances? A starting point is to think of human capital as 30% stock-like and adjust from there. For example, a tenured professor at a university may have more income stability than a real estate agent in a small town. Since that income is more “bond-like”, it may allow the professor to take on a higher equity (stock) allocation with her financial capital. Conversely, the real estate agent might want to consider a higher position in cash as a buffer for the times when home sale volumes are low.

Granted, the notion of that previous paragraphs can be abstract. What’s often more important are the risks we remove and not the risks we accept. When we have our wages dependent on the success and profitability of the company we work for, we need to be careful of our exposure to the stock of that company. Think of it this way: if there was an unforeseen event that caused the stock price of your company to collapse, how likely is it that your job would also be in jeopardy? If the chances are good (and they often are), you may have more risk exposure than you intended.

In practice, sometimes it’s not so easy to reduce company stock exposure. You may have access to employee stock purchase plans, stock options or restricted stock awards. Some may have different vesting periods and rules to follow. If you’ve held onto company stock for years and it has appreciated in value, you may have to think about how to unwind that position strategically considering the tax implications.

Finally, we cannot take human capital for granted. While it may be your largest asset, human capital is tied to your physical and mental health which can turn at a moment’s notice. That is why life and disability insurance are often such vital parts of a financial plan.

Housing Wealth

For the purposes of this section, housing wealth refers to your primary residence. If you own rental real estate, treat that as part of your financial capital.

Let’s first say there are likely numerous non-financial reasons to purchase and own your home. However, your home is typically NOT a good investment. Let’s look at a few of the reasons why from Blanchett’s research.

The risk of individual homes is approximately double that of home price indexes. Say what? Just like there is plentiful data for stocks and bonds, there is data that tracks the prices of homes. But because this home data gets aggregated in the figures, the risk (as measured by standard deviation) is quite low (around 5 to 6%) when we look at a country, state, or city level. But any individual home is subject to much more volatility (around 12%). There are unique risk factors to any single home that make it unreliable to look at data in the aggregate.

Per Blanchett, the above volatility is approximately the same as a portfolio investing in 60% stocks and 40% treasury bills. Depending on how large your housing wealth is on your balance sheet, it can impact the way you treat your financial capital.

The investment return for homes, even in the aggregate, has been poor. While the historical real returns for homes have been +1%, the actual real (after inflation) return realized by homeowners, after considering various costs associated with owning and selling a home, has likely been negative. Of course, where you live impacts what type of investment experience you would have had looking backwards. For example, in the US, the real returns for homes in San Francisco, CA has been substantially higher than homes in Cleveland, OH.

Renting can be a smart decision for many households. The “rent versus buy” decision (again from only a financial perspective) is not terribly complex. There are online comparisons that can help. It’s very dependent on the local housing market you live in. But your expected duration of homeownership is also a big factor. If you don’t expect to live in a home for at least five years, you’re probably better off renting. It’s worth noting that Blanchett’s research also showed that actual duration of homeownership tends to be significantly less than what homeowners expect. Simply put, people tend to move from a home sooner than they anticipate.

Let’s end this section with a caveat. While it may be one of your lowest expected return assets on your balance sheet, your home can paradoxically be one of your best investments too. As Dan Yerger astutely notes in Maximizing the Return of Your Home, owning a home (and paying off a mortgage) forces a long-term savings behavior that is ultimately wealth building.

Pension Wealth

Pension wealth refers to any guaranteed income sources that are typically not shown on your balance sheet. They can include company pensions but also Social Security income. For many retired households, pensions can be one of the largest, if not the largest asset owned.

If you were to include pension benefits on a balance sheet, there may be different ways to do that and there’s not yet one consistently applied approach by financial advisors. Blanchett suggests using something called a “mortality weighted net present value” formula. Among other things, this factors in inflation and life expectancy.

The bigger idea here is that a pension, if turned into an asset on the balance sheet, would often have a significant value. For example, a 45-year-old couple that is 20 years from the start of retirement would have a “multiplier” of 14.4. This means a $25,000 pension income could be valued at almost $400,000.

So why is this important? Having guaranteed income sources can impact the way you invest your financial capital. We often discuss what is the right mix of stocks, bonds and other asset classes in a portfolio. A pension can be thought of as a substitute for a bond or a fixed income investment. Depending on the size of your pension income and what percentage of your household expenses that pension covers should play a role in determining how much risk to take with your financial capital.

Some folks at or near retirement will take a portion of their financial capital and convert it into an annuity. That is a stream of income that typically pays out as long as you’re alive. If you’re in this camp, the annuitized income would be removed from your financial capital and added to your pension “bucket”. All else equal, it may allow you to invest remaining assets more aggressively.

Warning: this is not to advocate the use of annuities. They need to be approached with caution, especially if used in accumulation stage of wealth building. As I noted in a earlier blog, there’s almost no good case that can be made for equity indexed annuities.

Controlling Your Exposures

The point of this piece is that there’s a more nuanced way to think about how you invest. It can be somewhat abstract thinking about concepts like human capital, housing wealth and pensions. The goal isn’t to over-optimize or unnecessarily interfere with a sound investment strategy. But it’s our financial capital that we often have the most control over, quite literally at level of making trades. So why not make sure those portfolio decisions are done with a holistic framework. Ultimately, it’s about managing your risk exposures in a way that better helps you reach your financial goals.

If you have comments or questions on this piece, please drop me a line at: [email protected]

References

- https://www.cfainstitute.org/en/research/financial-analysts-journal/2015/no-portfolio-is-an-island

- https://krishnawealth.com/first-time-real-estate-investor-know-whats-really-involved/

- https://smartasset.com/mortgage/price-to-rent-ratio-in-us-cities

- https://www.mywealthplanners.com/2020/10/20/maximizing-the-return-on-your-home/

- https://krishnawealth.com/look-beyond-the-allure-before-using-equity-indexed-annuities/

The information on this site is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Krishna Wealth Planning LLC (referred to as “KWP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

KWP does not warrant that the information will be free from error. None of the information provided on this website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall KWP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the materials in this site, even if KWP or a KWP authorized representative has been advised of the possibility of such damages.

In no event shall KWP have any liability to you for damages, losses, and causes of action for accessing this site. Information on this website should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.