7-Minute Read

Working from home has been a growing phenomenon since the pandemic. For business owners, this provides unique challenges and opportunities. From a financial planning perspective, look no further than taxation.

Most business owners I meet want to minimize tax liability to the extent legally allowed. One benefit of being a business owner is you get to deduct legitimate business expenses from your income. If you’re in this group, you might substantially save on taxes by claiming the home office deduction.

Regardless of whether you own your home or rent it, you may be able to deduct a portion of your home’s costs if you use a space for business purposes. There’s no surprise you cannot treat personal expenses as deductible business expenses. But when you have business activity inside your home, things get more nuanced.

With that in mind, let’s take a deep look at the home office deduction. It’s not a hard concept, but it takes some preparation to reap its full potential. We’ll explore the rules, three tips to maximize this benefit, and an example to pull everything together.

The Home Office Deduction Rules

First, let’s clarify you don’t need to use a room in your home literally as an office. While a typical space with a desk and computer is the norm, plenty of other uses qualify. It can be workshop, lab, studio or really any home workspace that’s used for your business.

Before getting into tactics, let’s look at the two broad rules you need to know.

Rule #1 – Exclusive and Regular Use

Your home office must be used solely for business activities and not for personal purposes. You rarely can use a spare bedroom, den, or kitchen. That’s because it’s difficult to justify those rooms aren’t also used for personal reasons. The space you choose must be used exclusively for business purposes.

Fortunately, an entire room doesn’t need to be set aside. You can partition a room in a way that creates a clearly identifiable space for business activities.

As for regular business use, the rules are less black and white. There are no minimum hours of use that’s required. It’s based on facts and circumstances. Just know if you only use a home office occasionally, your tax deduction could be limited or disallowed. Plan to use the space regularly for business.

Rule #2 – Home Qualifications

Your home must also meet ONE of the three criteria below.

- Your principal place of business – The full details for this requirement are in Pub 587. Generally, it’s the main place you conduct business, but it doesn’t necessarily need to be the only place you conduct business.

- A place to meet with patients, clients, or customers in the normal course of business

- A separate structure that is used in connection with your business.

Assuming these rules are not an obstacle, let’s move next into the three tips to maximize this tax deduction.

One – Track the Right Expenses

With the home office deduction, you can deduct a portion of many expenses that typically don’t produce tax savings. We’ll define a little later how you figure out that portion. Here is a list of typical expenses that qualify for the home office deduction.

- Deductible Mortgage Interest

- Real Estate (Property) Taxes

- Rent

- Homeowners Insurance

- Utilities – Water, Trash, Electric, Gas, Internet

- Repairs & Maintenance

- Security Systems

- Cleaning

- Depreciation (see next section for more information)

The expenses above are considered indirect expenses attributable to your home office. As these expenses apply to your entire home, deductions will be limited. However, if you were to paint your home office, that would be direct expense and likely fully deductible.

Some of you may already be deducting home mortgage interest and property taxes separately as an itemized deduction. If so, you won’t be able to double dip and claim these as part of your home office deduction. However, it has become rarer in recent years to claim itemized deductions due to the larger standard deduction available.

It’s nice that many of your home related expenses can help lower your taxes, but there are challenges. Usually, these expenses are paid from your personal bank account or charged to personal credit cards. These may not be part of your normal business bookkeeping. So, you need a new habit or system to properly track your qualifying home expenses. You’ll need to store invoices, receipts, etc.

Time Saving Tip: If you prefer to skip the record keeping, you can use simplified method, which is just an IRS-set deduction for your home office. Currently, the maximum deduction you can claim is $1,500. That is computed as $5 per square foot on up to 300 square feet. At present, this deduction does not automatically increase for inflation. This method saves you time, but it often doesn’t save you the most money as we’ll see.

Two – Depreciate Wisely

When you start using your home for business, you will be required to start claiming depreciation. What does this mean?

Real estate investors are probably familiar with depreciation. Basically, it’s a special write off for tax purposes. While it doesn’t impact your actual cash flow, it helps to reduce your taxes.

To properly claim depreciation, you will need to know two figures:

- The Fair Market Value of your home

- The adjusted cost basis of your home

For both figures, you need to know them based on the date you started using the home for business purposes. You will then use the lesser of the two. These past few years have generally seen a rise in real estate prices. As a result, you may be more likely to use the adjusted cost basis.

Your tax preparer will usually handle the detailed tracking from here. You will claim depreciation based on a 39-year period. That equates to most years claiming around 2.564% of the appropriate figure above (before computing your business percentage – see next section).

Warning: When you sell your home, you will have to “recapture” this depreciation. All the depreciation you claimed will be taxed (for federal purposes) at the lesser of your marginal tax rate or 25%. This is perhaps the most practical drawback of using the actual expense method for calculating your deduction.

Three – Optimize Your Business Percentage

If you made it through the last two sections, you now know what types of expenses can be deducted as well as how depreciation works.

To figure out your final deduction, you need to know how much space in your home you’re using for business. Remember it needs to be a space that is exclusively used for business.

The IRS allows reasonable methods for computing this, but here the most typical methods used:

- Number of Rooms

- Square Footage

The “number of rooms” method can be used if all the rooms in your home are approximately the same size. For example, you have five rooms in the home and use one for business. You can then allocate one fifth of the expenses noted above, or 20 percent.

If your rooms are of unequal size, you would allocate expenses based on the “square footage” method. Determine the size of your home office and your entire home. Divide the two to get your percentage of business use.

If a reasonable method is used to determine your business percentage, it should be allowed by the IRS. I’ve seen case studies for the “square footage” method where common areas and hallways are excluded from the calculation of the entire home size. That may be one way to get yourself a slightly higher business percentage.

Home Office Deduction Example

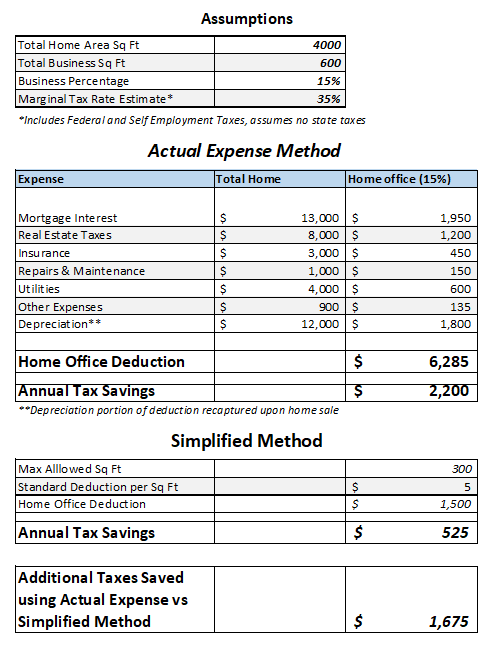

The following chart is an example that pulls together the concepts in this blog to give you an idea of the power of the home office deduction. Your own results may vary!

Where to Report and Other Tips

When it comes to the actual tax reporting for the home office deduction, you can (and probably should) seek professional help. But if you’ve read through the tips above, you’ll notice that you need to track and provide most of the figures.

IRS Resources

If you plan to do the actual reporting yourself, reference these two key IRS resources:

Final Tips and Warnings

While I attempted to give thorough coverage to the home office deduction, I can’t capture every nuance in a blog post. But I’ll leave you with a few final tips:

- Profitability – For any years your business is not profitable, your home office deduction will be limited or disallowed. Sometimes that’s called running a net operating loss (NOL). If you claim the actual expense method, your deduction isn’t outright lost but it can be carried forward to a future year where there is income to offset it.

- Simplified Method – If you choose to elect this method, you can ignore most of the content in this blog. Just be sure to use accurate square footage for the space you’re using for business. You don’t have to worry about record keeping and depreciation.

- Special Business Uses of Home – there are always some exceptions. If you run a day-care facility, storage unit, or mobile office, special rules will apply.

- Employee Owner – It typically doesn’t matter what type of business you have (C-Corporation, S-Corporation, LLCs, Partnerships, and Sole-Proprietor). But C Corp and S Corp owners can qualify as employees. If that’s you, you won’t use Form 8829 above but rather get reimbursed from the business through what’s called an accountable plan.

I hope this blog provides a holistic view of the home office deduction. It can be a powerful tool in your tax planning toolkit. While many details were covered, your specific tax situation could be unique. Consult a tax professional such as a CPA or IRS enrolled agent to help you take proper advantage of this strategy.

If you have comments or questions on this piece, please drop me a line at: [email protected]

References

- https://www.irs.gov/publications/p587#en_US_2022_publink1000226302

- https://krishnawealth.com/have-goals-but-focus-on-systems/

- https://www.bankrate.com/real-estate/adjusted-basis-for-property/

- https://www.irs.gov/forms-pubs/about-form-8829

- https://www.irs.gov/forms-pubs/about-form-4562

- https://www.irs.gov/pub/irs-pdf/p5137.pdf

The information on this site is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Krishna Wealth Planning LLC (referred to as “KWP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

KWP does not warrant that the information will be free from error. None of the information provided on this website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall KWP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the materials in this site, even if KWP or a KWP authorized representative has been advised of the possibility of such damages.

In no event shall KWP have any liability to you for damages, losses, and causes of action for accessing this site. Information on this website should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.