In today’s information abundant age, it has become increasingly difficult for an advisory firm to consistently outperform other firms. But I believe a qualified advisor can add value in ways going beyond performance. My first goal is to prevent clients from taking inappropriate action based on fear or misinformation. Next it is vital to focus on the day-to-day investment management process, which most people do not have the time or desire to do.

I believe people want to live the best life possible from the resources they have. Care and diligence is needed by the advisor to ensure clients are taking enough precaution to avoid dangerous outcomes but also ensuring that their money is serving them and frugality is not taken to an extreme. For people to take action, they need to clearly see how taking that action will improve their outlook or remove a large risk. By never losing sight on what’s important to my clients, I believe that sound advice and creative solutions can emerge.

I believe the services offered in this firm are incredibly valuable. That value is reflected in my pricing structure. But I also believe that the cost of a professional service should be connected to the amount and quality of work being performed. That is why we have a tiered/blended fee structure that practically limits the fees my firm can charge. If we help you prosper beyond a certain point in your finances, that money should be predominantly for you and your family to keep and strengthen your long-term financial plan.

Our process keeps a focus on risk exposure, diversification, cash flow, tax efficiency, cost control and rebalancing under a rules-based methodology. Furthermore, I believe no investment strategy is complete without being integrated into a robust and holistic financial plan.

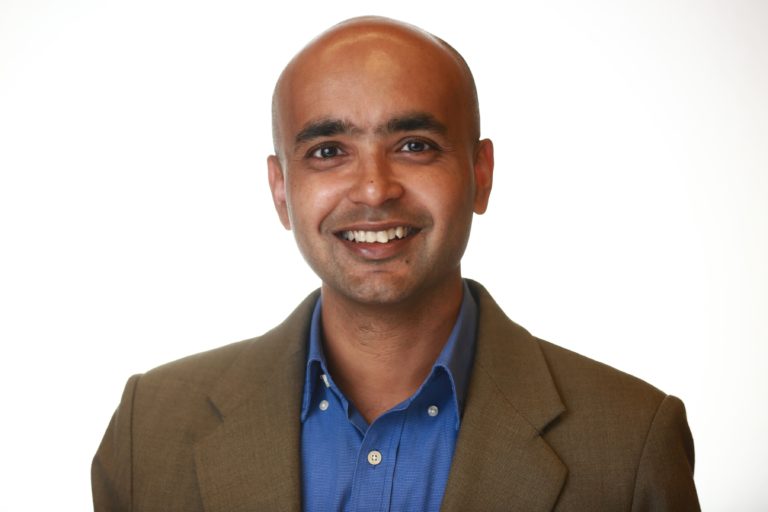

My name is Neil Krishnaswamy. I have long been intrigued by the challenge we face to live the most abundant life we can NOW while also building a secure foundation for the future. For the past decade, I’ve sought answers by building and refining processes to help people allocate their resources in line with their goals and make better decisions. This journey has manifested into the formation of an independent financial planning and investment firm, called Krishna Wealth Planning.