7-Minute Read

“Profitability isn’t an event; it’s a habit.”

– Mike Michalowicz

Are you an entrepreneur or wish to be one? You probably believe that your business will improve the quality of your family members’ lives while positively impacting your customers and employees.

Challenges inevitably arise while turning your vision into a reality. Does your business serve you or do you end up serving the business? Is your company growing but you feel stuck on a treadmill and unsure if you’re getting closer to financial independence? I wish I had all the answers. But I am encouraged by the possibilities ahead if you adopted a “Profit First” mindset. In this piece, we explore:

What Is Profit First?

Entrepreneurs are most likely familiar with the adage “it takes money to make money”. To achieve growth and obtain organizational efficiency, profits must often be reinvested back into your business. While many successful businesses you see have taken that approach, be mindful of only looking at the survivors.

While you should be careful interpreting the failure statistics, approximately half of all small businesses don’t survive past five years. Sometimes the failure is due to a lack of skill. But often it’s bad luck or unfortunate timing. It might be the right business idea but at the wrong time. Regardless of cause, failure is linked to the business no longer being profitable.

As Mike Michalowicz suggests in his thought-provoking book Profit First, profit may be more in your control than you might think. By putting profit first, you might increase the odds of having your business not only survive but thrive.

Creative Constraints

I look at the Profit First system as being built around behavior science principles. Parkinson’s law states that demand grows to meet supply. The equivalent for you as an entrepreneur could be that expenses rise to match the money available in your bank account.

But if a portion of your company’s revenue is removed at the beginning, taken as profit first, it makes you operate under a constraint. Constraints can be good in this context. A forced frugality makes you scrutinize expenses and get more creative about how to achieve the same results with less resources.

Another interesting aspect of Profit First is the primacy effect. You tend to focus more on the things you see first. For example, look at these two forms of the same equation.

- Sales – Expenses = Profit. In this view, profit is only what is left over. This is the traditional accounting viewpoint.

- Sales – Profit = Expenses. Here expenses are what is left over when you take profit first. Does your mindset change when viewing it this way? I know mine has.

Start Taking a Small Profit

What if you’re not taking any profit today? You don’t have to allocate a large profit percentage in the beginning. In fact, the author suggests you start very small at 1 percent of revenue. That’s hopefully a figure so small you wouldn’t even feel it. That’s by design. Most good habits, financial or otherwise in life, have a better chance of sticking if they are easy to do in the beginning. It’s a small step to make it more likely your business remains profitable from here on out.

Bigger vs Better

Which question below resonates with you more?

- How do I make my business bigger?

- How do I make my business better?

It’s kind of a trick question. Most business owners want both. One way I’d describe the profit first mentality is that if you focus on making the business better (more efficient, more profitable), getting bigger could happen more naturally.

If you take your profit first, you’re choosing to be disciplined about the money you’re spending and investing back into your business. You’re forcing yourself to focus, streamline and innovate.

Profit First Can be a Buffer for Bad Times

Michalowicz has plenty of humorous quips in his book. One that resonates with me is this: “There are two times when business owners need to be very concerned. One is when is when sales slow or decline. The other is when sales are growing.” Funny, but true. I’m personally more concerned with the former because it creates an immediate pain point to address.

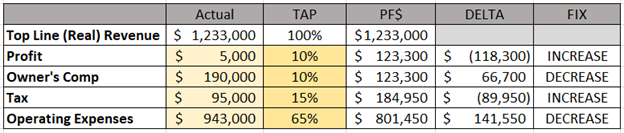

As a business owner, you might notice pain but not really want to confront it. One powerful recommendation is to complete an “instant assessment” for your business. The book outlines a step-by-step procedure to complete this. In the figure below, I show a real example using a law firm that went through the process.

While I won’t discuss every assumption in this table, an instant assessment brings clarity fast. In this case, it reveals that the law firm is a “break even” business. Even with over $1.2 Million in annual revenue, one bad month of sales could be very painful. To get in front of this, the owners might consider working towards the following targets suggested by Michalowicz.

- Increase Profit Allocation – A firm of this size should have a 10 percent target allocation to Profit. See the TAP column. In dollar terms, this firm is $118,000 short of the target as shown in the Delta column.

- Reduce Owner Salary – This is the Owner’s Comp row, which is represented as an after-tax figure. These owners are likely drawing more for their lifestyle than the business can afford. With a 10 percent target, they would need to cut their salaries by $67,000.

- Increase Tax Allocation – This might sound controversial, but a healthier business needs to pay a higher amount of taxes. Notably a 15 percent tax target works surprisingly well for businesses of different sizes. Some business owners choose to minimize their “tax tap”. They take strong measures to lower taxes, often increasing unnecessary expenses in the process.

- Cut Operating Costs – With a 65 percent target, this firm would have to cut expenses by over $141,000. This sadly could involve the need to cut staff.

These are tough choices. But it’s arguably better to make these decisions proactively to ensure the health of the business rather than be forced to take drastic actions when the bad times arrive.

Of course, this is only one simple example. Different businesses will have different visions and targets for profitability. The key idea here is this: having a healthy profit margin gives you a better chance to survive the down times. Don’t underestimate survival; it’s a precondition for your business to thrive.

How I Currently Apply Profit First at my Firm

I’ve had healthy debates with other financial planners about how and why to implement Profit First. I believe the mindset is useful even if the specific tactics you use look different from other businesses. At this time, I’ve applied a partial version of the Profit First system.

I’ve made gradual progress over the past year and now consistently allocate five percent for profit. This may not sound like much, but I’m grateful when I think about how the firm has grown since launch in 2019. I also have a higher profit allocation target for future years. I find that helps me focus on continually finding efficiency improvements and better ways to manage operating expenses.

Notably I have not applied the full system Michalowicz recommends. That would involve opening separate bank accounts for income, profit, operating expenses, owner’s compensation, and taxes. In fact, you would have at least seven total bank accounts and two different banking institutions involved if you followed the system completely.

Why add such complexity? You might have heard about the envelope system. This is where you put money in certain envelopes for various expenses like mortgage, groceries, vacations. In the days before credit and debit cards were prominent, this was a practical habit for families who needed to stick to a budget.

The envelope system is a behavioral technique to ensure you don’t overspend. If there’s no money left in an envelope, you’re not spending any more in that category. Using different bank accounts can help enforce a discipline like the envelope system. If you had a different bank account to collect your profits, it’s tougher to claw back into that. This is especially true if you keep a profit account in a different bank from where you handle your operating expenses.

I see the rationale, but I’ve chosen for now to keep my banking and accounting systems simple. I’m a spreadsheet guy, so I use those for tracking and executing the necessary allocations. I admit this approach isn’t for everyone. I am willing to try this more elaborate banking system in the future.

The Profit First Can Work for Anyone, Not Just Business Owners

There are lessons from Profit First you can apply to your finances even if you’re not a business owner. You may have heard of the concept “pay yourself first.” The goal here is to first save and invest before you pay any other expenses. You may already be doing this if you’re contributing to your company’s retirement plan.

If you’re having trouble saving money, start small at 1% of your income and build from there. It doesn’t sound like much, but it’s more about building a habit in the beginning. Over time, create a system to increase your target savings percentage. This is like a business owner increasing a profit allocation using the system described in this piece.

Retirement plans, like 401ks, often allow you to automatically increase your savings percentage each year. This is helpful because it opts you into the correct behavior and requires you to opt out if you don’t want it. Since it takes conscious effort to opt out, you’re more likely to stick with the program.

Good financial behavior doesn’t always come naturally. Going back to the opening quote of this piece, Profit First is just a habit. It takes time to build effective habits. Find and experiment with a system that works for you. I hope this piece gave you at least one idea worth trying.

If you have comments or questions on this piece, please drop me a line at: [email protected]

References

- https://www.entrepreneur.com/article/361350

- https://profitfirstbook.com/

- https://www.investopedia.com/terms/p/payyourselffirst.asp#:~:text=%22Pay%20yourself%20first%22%20is%20a,or%20discretionary%20purchases%20are%20made.

The information on this site is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Krishna Wealth Planning LLC (referred to as “KWP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

KWP does not warrant that the information will be free from error. None of the information provided on this website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall KWP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the materials in this site, even if KWP or a KWP authorized representative has been advised of the possibility of such damages.

In no event shall KWP have any liability to you for damages, losses, and causes of action for accessing this site. Information on this website should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.