5-Minute Read

Along with the recent election results, another thing that might be on your mind now is health insurance. For one, it is open enrollment season for many employees. Two, the Supreme Court is considering the fate of the Affordable Care Act (Obamacare) which generally affects those not covered by their employers.

Some things are out of your control, but one decision you can make is how to save for your healthcare expenses. That’s where health savings accounts (HSAs) come in the picture. While you may already know about HSAs, I find that most people underestimate how powerful they can be. This piece explores why and shares one strategy at the end that most HSA owners miss.

The Triple Tax Benefits of Health Savings Accounts

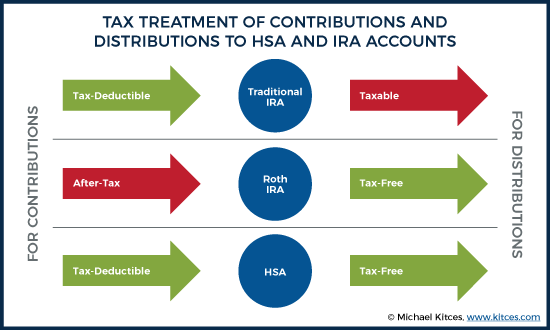

Most retirement accounts have two different levels of tax benefits. Traditional IRAs, for example, give you an upfront tax deduction for your contributions and then your account grows tax deferred. You’re only taxed when you make future distributions. Conversely, Roth IRAs also grow tax deferred and you potentially get tax-free distributions in the future. You just don’t get the upfront tax benefit for your contributions.

From a tax perspective, HSAs can be the of both worlds. As the following picture shows, you can get both tax-deductible contributions and tax-free distributions! The following sections will cover some of the rules for properly capturing those benefits. Since HSAs also provide tax deferred growth of assets like IRAs, that is how we get to three total levels of tax benefits available.

As there are no other investment vehicles currently available in the US that provide three levels of tax benefits, you can make a strong argument that contributing to an HSA should be your highest priority for dollars available to save. The higher the tax bracket you’re in, the stronger the case.

Contribution Considerations for HSAs

Are you eligible for an HSA? Here are the three general requirements:

- You need to have a high-deductible health insurance plan (HDHP). This means it has a $1,400 minimum deductible for an individual or $2,800 minimum deductible for a family (2020).

- Your plan must be HSA eligible with a maximum out-of-pocket of $6,900 for individuals and $13,800 for families (2020).

- You cannot be claimed as a dependent on another person’s tax return.

If the three requirements above are met, you can contribute as much as $3,550 per year to an individual plan or $7,100 to a family plan. If you’re age 55 or older, there’s an additional $1,000 catch-up allowed. All figures are based on 2020 limits.

Despite the tax benefits, signing up for a high deductible health insurance plan is not a choice to take lightly. Your personal circumstances and family’s health might suggest you’re better off with a low deductible plan which typically comes with a higher premium.

A few tips on HSA contributions

- If you access an HSA through your employer, they might match a portion of your contributions. If so, that’s great but those contributions count towards your annual maximum limits noted above.

- What you can contribute to an HSA may need to be reduced if you started, changed, or lost a health insurance plan this year.

- If you’re 65 or older and applying for Medicare this year or the first 6 months of next year, you can only make pro-rata contributions. Eventually you would want to cease contributions once you’re on Medicare.

Distribution Considerations for HSAs

So, we mentioned that HSA distributions can be tax-free. The main caveat is that your distribution must be attributable to qualified medical expenses (QMEs) to get tax-free treatment. QMEs are really a broad category. They can be expenses to treat or prevent a physical or mental illness. Even expenses used to pay for long-term care insurance premiums partially qualify as a QME based on your age. The full list can be found in IRS Publication 502.

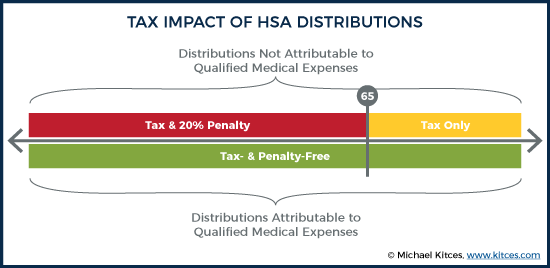

There are consequences if you make a distribution from an HSA that cannot be substantiated with a QME. The distribution would be subject to ordinary income taxes and a 20% penalty. The good news is that outcome should be avoidable with a little care.

A few tips on HSA distributions

- A health expense you paid is “qualified” if you did NOT receive a benefit in some other way. For example, this can be a reimbursement from health insurance, or claiming the expense as a separate medical deduction.

- There is no time limit for when a distribution can be made to pay for a qualified medical expense.

- While money does not need to be in the HSA at the time the expense is incurred, the HSA should at least be opened first.

- Keep good records and save your receipts in case you ever need to justify your distribution with the IRS.

The Often-Missed Strategy for HSA Owners

The common way people use an HSA is to reimburse themselves shortly after qualified medical expenses are incurred. That’s simple and quite acceptable, but there is another way to look at this.

Unlike other employer benefits like Flexible Spending Accounts (FSAs), HSAs are not “use it or lose it”. You can use them for long-term wealth accumulation! Many plans today allow you to invest your entire account dollars with the exception a cash maintenance requirement (typically $1,000).

If you can manage to pay your current medical expenses with other resources, you can then earmark your HSA for future health expenses. Why do that? The simplest reason is you can let tax-free compounding work to your advantage.

Create Your Own Medicare Spending Account

When we think of future health expenses, we often think about Medicare. It’s worth noting that Medicare Part B and Part D premiums do count as eligible expenses for HSAs, but premiums for supplemental policies do not. The idea here is that households typically have some level of predictable health related expenses in retirement.

With that in mind, consider this example. If a married couple, where both partners are age 65, can keep their annual income under $174,000 in retirement, they would each face Medicare Part B premiums of $144.60 per month and average Medicare Part D premiums of $32.74 per month. This equates to combined annual premiums of around $4,256 per year for the household.

If this couple wanted to fund 25 years of premiums from a dedicated tax-free account like an HSA, I estimate they would need an account value today worth under $84,000. This assumes looking forward the account grows at 6 percent per year and Medicare premiums grow 4 percent per year for inflation.

Most retired folks I’ve met don’t have an HSA account nearly that size. It’s not necessarily because they couldn’t have afforded to get to this outcome, but more often it is simply that this strategy didn’t occur to them. Of course, you would need have to an HSA with quality investment choices and reasonable costs that can give you the production you need over time. But all else equal, there may not be a better tax efficient way to get to your target health savings amount than with an HSA. This is due to the triple tax benefits mentioned earlier.

On the flip side, you might worry about getting too aggressive with an HSA resulting in over funding it. One nice thing for those who have HSAs and are over 65 (or disabled), even if the distribution you make cannot be tied to a qualified medical expense, you can still avoid the 20 percent penalty, but you would need to treat the distribution as taxable income. This outcome is functionally no different than funding and withdrawing from a typical retirement account like an IRA. If this were the worst-case scenario, you’d be left with a double tax benefit instead of a triple.

Bottom line: There are compelling reasons to make HSAs a part of your long-term wealth accumulation and distribution plans.

If you have comments or questions on this piece, please drop me a line at: [email protected]

References

- https://www.medicareinteractive.org/get-answers/coordinating-medicare-with-other-types-of-insurance/job-based-insurance-and-medicare/health-savings-accounts-hsas-and-medicare

- https://www.irs.gov/pub/irs-pdf/p502.pdf

- https://www.medicare.gov/your-medicare-costs/part-b-costs

- https://www.medicareinteractive.org/get-answers/medicare-prescription-drug-coverage-part-d/medicare-part-d-costs/part-d-costs#:~:text=Your%20plan%20cannot%20change%20your,Medicare%20drug%20costs%20for%202020.&text=Varies%20by%20plan.,Average%20national%20premium%20is%20%2432.74.

The information on this site is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Krishna Wealth Planning LLC (referred to as “KWP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

KWP does not warrant that the information will be free from error. None of the information provided on this website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall KWP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the materials in this site, even if KWP or a KWP authorized representative has been advised of the possibility of such damages.

In no event shall KWP have any liability to you for damages, losses, and causes of action for accessing this site. Information on this website should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.