8-Minute Read

As a result of the tumultuous 2020 US election, you are probably aware that the Democratic Party now has control over the Presidency and Congress. The Senate is controlled by the slimmest of majorities after final two Senate seats in Georgia recently went to Democrats.

All it takes to pass most federal tax law changes is a simple majority vote. Some major policy changes require 60 Senate votes, but many of the meaningful changes we’ve seen in tax law over the past few decades were done with a simple majority using special budget procedures. That said, a new tax bill is likely to be passed within the next one to two years. This piece attempts to capture the key changes we can expect to see.

Considerations for the Biden Tax Plan

There are a few points to note upfront to set the stage. First, tax legislation may not be the highest priority item for Congress and the President at the present moment. The immediate focus is on negotiating further relief for the COVID-19 pandemic. The President’s $1.9 Trillion relief plan calls for more direct payments to qualifying households, unemployment insurance supplements, and more money to go into vaccine testing and distribution. Of course, some measures that affect taxes could get thrown into such an upcoming bill.

The fiscal challenge is that between last year (2020) and this year, we’re looking at unprecedented levels of federal budget deficits. What we all hope to avoid is future economic damage from over borrowing. This could eventually come in the form of higher inflation or currency devaluation. As such, the likelihood for higher future taxes appears strong even if that projects to cover only a portion of budget deficits in the coming years.

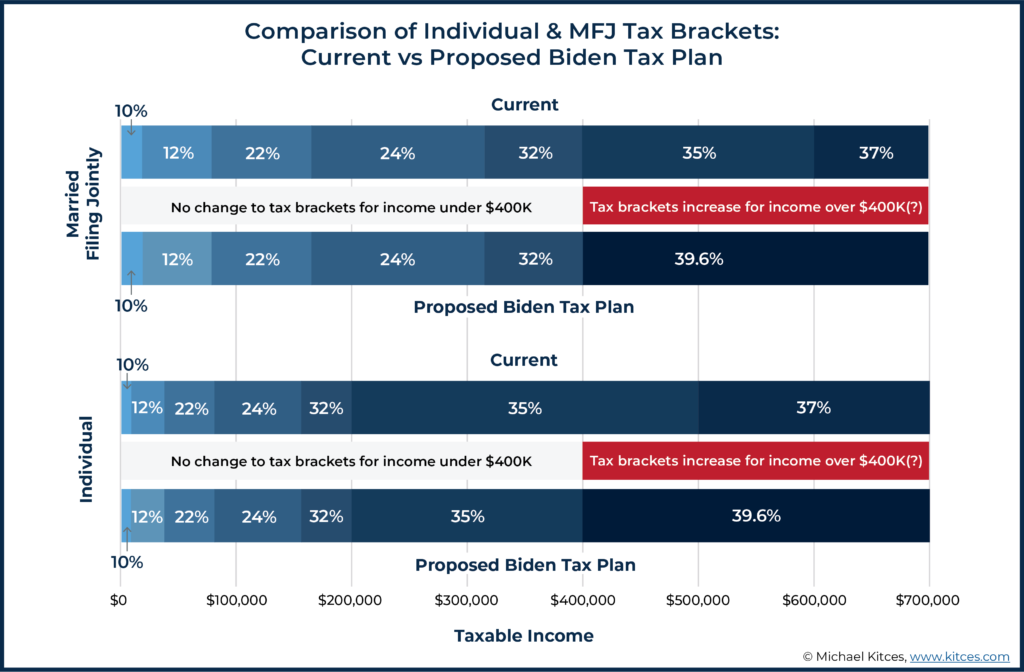

One thing we can surmise from President Joe Biden’s tax plan is that the burden for higher taxes will fall to those with higher incomes. Generally, you should expect to see tax increases if your household income is above $400,000. That seems to be the magic threshold. It’s still not fully clear if there will be differences in the way that threshold is applied to individuals versus married couples. But the key is that the top 1 percent (or so) of US households project to shoulder the burden for paying higher taxes.

The potential changes we could see in tax legislation are summarized in the sections below. We don’t know with certainty what combinations and magnitudes of these changes will get passed. Do we see action from Congress on this before or after the pandemic recedes? If the tax law does change, will the changes be retroactive to January 1st, 2021 or will they start to apply in one of the coming years? These are all questions that should be answered in due time.

Potential Tax Changes for Individuals and Families

Higher Top Individual Tax Rate

The current highest individual tax rate that can apply to taxable incomes is 37 percent. This came from the Tax Cuts and Jobs Act of 2017 (or TCJA). Expect the highest rate to revert to previous highest level of 39.6%. Since it would likely apply to incomes above $400,000, it would currently impact those paying taxes now at the 35 percent marginal bracket. See picture below, courtesy of Kitces.com. Even if there were no legislative changes, this was scheduled to happen anyway in 2026. The time frame would just be moved forward.

We’re focused on individuals and families in this piece. But notably we’d likely see the corporate tax rate also increased from its current rate of 21 percent (per TCJA) back to somewhere around 28 percent.

Higher Investment Tax Rates

Currently the maximum federal tax rate for long-term capital gains and qualified dividends is 23.8%. These would apply to investment income generated in taxable (non-qualified) accounts. Biden’s plan calls to increase the investment tax to a 43.8% rate (39.6% maximum ordinary rate plus 3.8% surtax) on incomes above $1 Million.

If this went through, it would be quite a potential tax hike for the highest income households. That would nearly double the tax rate on at least a portion of investment income. This may end up getting negotiated down to something less severe. In any event, it would create a new wrinkle in year-to-year planning for this cohort.

Higher Social Security Payroll Taxes

Social Security reform always seems to be a controversial topic. How solvent is the system and how will it be funded going forward? The Social Security portion of the payroll tax rate is set by statute at 6.2 percent of wages for employees and employers (12.4% for self employed income). It’s currently subject to a cap ($142,800 in 2021 – indexed for inflation). In other words, no wage income above that cap is subject to this taxation.

Biden’s plan calls for subjecting wages over $400,000 to the Social Security tax. If there’s enough political will to get this measure passed, it would be a step towards making Social Security system more solvent. However, it would produce an odd “donut-hole” effect in that wages between $142,800 and $400,000 would be exempted. That’s quite arbitrary, but that would be the only way to not break the promise of increasing taxes on those earning less than $400,000!

Mixed Impact to Itemized Deductions

Most middle- and lower-income households do not itemize deductions when filing their tax returns. That’s because they already receive a high standard deduction ($12,250 single filers, $25,100 joint filers – 2021).

Higher income households tend to benefit more from itemizing as they may have larger charitable contributions and mortgage interest payments, to name a couple of examples.

Biden’s tax plan would cap the value of itemized deductions at 28%. This effectively means that for families at the 32% federal marginal tax rate (or higher), they would no longer get to claim full deductions.

One potential offset to this is raising the limit on how much state and local taxes (a.k.a. SALT) can be deducted. The current limit is $10,000 which does disproportionately impact taxpayers in states with high state income taxes (e.g., California, New York). The plan calls for raising this “SALT” limit up to $20,000. If this change is passed, it could also reintroduce more planning opportunities for those who pay relatively larger property taxes on their home.

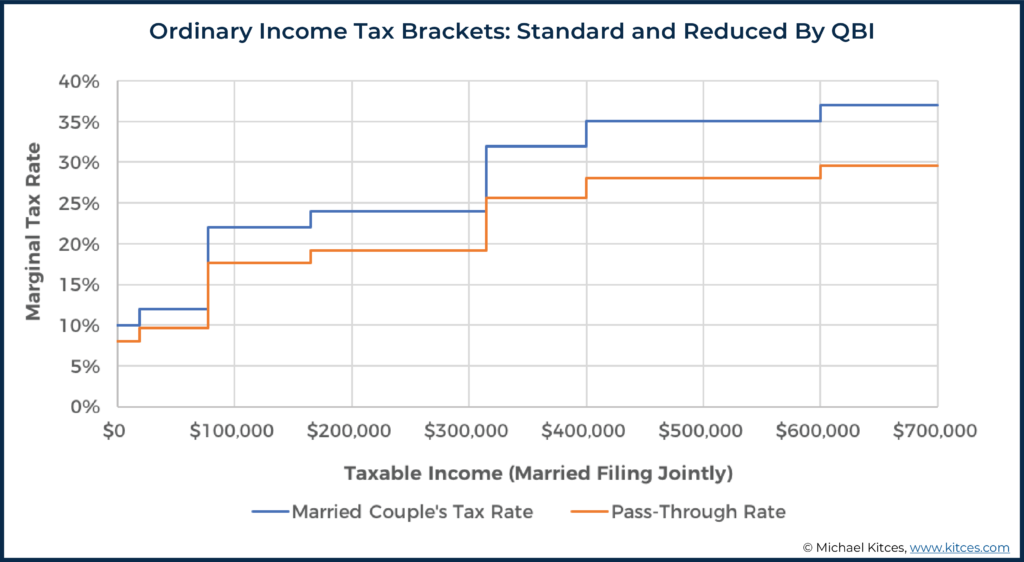

Restrictions on the Qualified Business Income Deduction

This so-called “QBI” deduction applies to business owners like partnerships, LLCs, S Corporations and sole proprietors. It potentially allows them to deduct 20% of their business income, which could effectively mean they are only taxed on 80% of their business income. This effectively reduces the top marginal tax rate as shown in the picture below.

There are already numerous complications and phase outs that apply to claiming this deduction. But the new tax plan would effectively eliminate the QBI for taxpayers with more than $400,000 income.

New Flat Credit for Retirement Contributions

This one could be interesting if it’s included in a future tax bill. Normally when we make contributions to a pre-tax retirement account like a 401k or IRA, we deduct that amount from our income. The new tax plan could have the retirement deduction eliminated and replaced with a flat credit instead. It’s not completely clear what that credit amount would be, but it has been estimated that 26% would be the “revenue neutral” level.

The idea behind this change is to equalize the benefits of retirement contributions across the income scale. In other words, higher income families wouldn’t get a higher tax benefit (in true dollars) than a lower income family.

If something like this flat credit comes to fruition, it will change the way we think about what type of accounts we use to save for retirement. Those in the lower tax brackets (say 10% of 12%) would get a much better tax benefit for making retirement contributions. Conversely, those in higher tax brackets would get less benefit and be less incentivized.

The short- and long-term planning implications of a change like this could be substantial. At a minimum, it will change the way we think about contributing to Roth-style (tax free) accounts.

Reduced the Estate and Gift Tax Exclusion

Most families today are not subject to a federal estate tax. That’s because the current law allows any individual to exclude around $11.7 Million in assets to be excluded from the calculation before any estate taxes apply.

Look for the estate tax exclusion amount to be significantly reduced. Perhaps it will go down to $6 Million per individual. It might even go lower.

We won’t get into the details in this piece. But these types of estate tax-related changes, which occur frequently in different administrations, can impact what type of wealth transfer strategies are used to provide for future generations. Techniques often involve complex trusts and lifetime gifting strategies that require careful coordination with financial advisors and estate attorneys.

Elimination of Step-Up in Basis for Inherited Assets

One rule that has been in the tax code for a long time is to allow those who inherit an asset to have the cost basis of that asset made equal (or stepped up) to the fair market value of the asset on the date of the decedent’s death. This means that any built-in investment gain prior to death would not become a tax issue for those inheriting the assets. Biden’s plan has called for eliminating this “step-up in basis” treatment.

Unlike the potential changes previously noted, eliminating the basis step-up could create both administrative and tax issues for future generations. That’s because when someone inherits an asset, they often simply do not know what the original cost basis the original owner had. If taken to an extreme, this could mean that all inherited assets (with some exceptions like IRAs) would be treated as a capital gain at death. This in turn could create a liquidity issue for estates to settle a tax liability at death.

Again, this change may not go through. It may turn out to be more feasible simply lower the estate tax exemption to a lesser level (as noted in the previous section) that can truly be passed to heirs tax-free.

New and Expanded Tax Credits

If it hasn’t been clear from the previous sections, practically all the expected changes that would result in higher taxes will apply to those with higher levels of income and/or assets. For lower- and middle-income households who qualify, there is a sample of possible tax credit changes on the horizon.

- Child Tax Credit – Currently there’s a credit of $2,000 per child under the age of 17. This could get increased to $3,600 for children age 5 and under, and $3,000 for older children but under age 17.

- Child and Dependent Care Credit – The current credit is a maximum of $3,000 for one child, and $6,000 for two or more children. This could get expanded to a refundable credit of $8,000 for one child, and a $16,000 credit for two or more children.

- Earned Income Tax Credit – For workers age 65 and older, this is currently capped at $538 for taxpayers with no qualifying children. The credit would be increased to close to $1,500. It would possibly allow for a higher income limit and an elimination of the age-65 cap.

- First-time Homebuyer Credit – This is a proposed $15,000 refundable tax credit to help first time homebuyers purchase a property. Similar credits like this have been adopted in the past and were capped at 10 percent of the home’s purchase price.

- Caregiver Credit – A new credit of up to $5,000 would be created to support informal caregivers. That is family members or loved ones who proved unpaid long-term care services.

If you have comments or questions on this piece, please drop me a line at: [email protected]

References

- https://www.wsj.com/articles/biden-to-propose-1-9-trillion-covid-19-package-11610661977?mod=article_inline

- https://bipartisanpolicy.org/report/deficit-tracker/#:~:text=The%20federal%20government%20ran%20a%20deficit%20of%20%243.1%20trillion%20in,of%20the%20economy%20since%201945.

- https://taxfoundation.org/joe-biden-tax-plan-2020/

- https://www.taxpolicycenter.org/briefing-book/how-did-tax-cuts-and-jobs-act-change-personal-taxes

- https://www.kitces.com/blog/biden-tax-plan-cuts-democrat-proposal-capital-gains-396-increase-estate-exemption-retirement-credit/

- https://www.ssa.gov/oact/cola/cbb.html

- https://krishnawealth.com/seven-ways-to-maximize-your-tax-free-assets/

- https://www.irs.gov/businesses/small-businesses-self-employed/estate-tax

The information on this site is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Krishna Wealth Planning LLC (referred to as “KWP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

KWP does not warrant that the information will be free from error. None of the information provided on this website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall KWP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the materials in this site, even if KWP or a KWP authorized representative has been advised of the possibility of such damages.

In no event shall KWP have any liability to you for damages, losses, and causes of action for accessing this site. Information on this website should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.