10-Minute Read

“I don’t know if I can live on my income or not – the government won’t let me try it.”

– Bob Thaves (Cartoonist)

One of my goals as an advisor is to help people capture enough investment returns to meet their productivity needs while also allowing them to sleep well night. Numerous challenges arise on this journey. Among them is the returns we seek need to be large enough to overcome headwinds such as fees, rising costs of living and perhaps the most bewildering of all…taxes.

This piece explores why it can be a sound strategy to build and grow your investments in tax-free vehicles. We’ll look at seven ways to maximize tax-free assets. These are steps towards building a tax-efficient retirement income plan, with greater flexibility and a higher likelihood of saving taxes over a lifetime.

Why Care About Maximizing Tax-Free Assets?

Let’s start with why. We begin by facing the risk that income tax rates could rise in the future. Depending on if this happens and the magnitude that it does, accessing a portion of your investment assets without tax consequences could be quite a valuable option to have.

We live in a time where our country’s fiscal and monetary policies are based on making our current conditions as pleasant as possible at the risk of increasing future economic and social vulnerability. This isn’t meant to be a political statement; it’s more the reality of our system and the complex incentives our leaders face. The federal government’s fiscal year 2019 deficit came in at a staggering $984 billion. Meanwhile, the federal reserve continues to be accommodative, having cut interest rates again which puzzles many in the advisor community.

With the passage of Tax Cuts and Jobs Act in 2017, this generation of investors may never see a lower tax environment than what we are in now. Higher taxes in the future might not be inevitable, but the argument here is that it is a risk to take seriously.

One way to deal with a risk, at least one that is not easy to avoid, is to diversify your exposure to it. Having different investment vehicles, with differences in how they are treated for tax purposes, can give you more flexibility to access money for spending in the future.

What do I mean by different “vehicles”? If you regularly save for retirement or you’re already retired, the odds are that most of your investment assets are in tax-deferred investment vehicles. These include traditional IRAs, 401(k) plans and 403(b) plans for non-profit organizations. Money contributed to these types of accounts has helped lower the taxes you’ve paid. Plus, any earnings (growth) on those savings (that hasn’t been withdrawn) has also not been touched by Uncle Sam.

The risk is that distributions from tax-deferred accounts, whether for retirement spending or anything else, will eventually be subject to taxation. For some households this tradeoff (deferring versus accelerating taxes) will prove to be worth it. In other cases, having deferred taxes for too long can create challenges down the road when taxes must ultimately be paid. What happens if we are in a dramatically different tax environment when that times comes?

Let’s turn to some ways you might mitigate this risk and maximize your own tax-free assets.

One – Roth IRA Contributions

When making a contribution to a Roth IRA, you do not get an upfront tax benefit, or deduction. But as long as you meet certain requirements, distributions from Roth IRAs will be tax-free in the future. Since these distributions include both contributions and growth, funding Roth IRAs is one way to hedge against the possibility of higher tax rates in the future.

There are limits to your contributions based on your household income. For 2019, you can generally contribute up to $6,000 per year, plus an additional $1,000 if you’re age 50 or older. See strategy #7 below if this applies to you.

Consider that $6,000 invested each year in a Roth IRA with a 6.5% average annualized return results accumulating over $500,000 tax-free in 30 years. Potentially double this amount for married couples. While this may be the simplest way to build tax-free assets, it’s not easy and does require patience.

A couple of other reasons I usually prefer Roth IRAs over traditional IRAs:

- In the current law, there are no required minimum distributions after reaching age 70 ½.

- If necessary, you can access the contributions you have made to a Roth IRA without taxes or penalties before reaching age 59 ½.

Two – Qualified Plan Contributions (e.g. Roth 401k)

If you own or work for a company that offers a Roth-style qualified retirement plan (typically a Roth 401k), this could be a way to build up tax-free assets even faster than a standard Roth IRA if you have the capacity to save more.

Employee contributions to 401k plans for individuals is $19,000 per year for 2019 plus a $6,000 catch-up allowance for those age 50 and older.

The key here is to explore whether your company offers a Roth solution. If it does, it may not be the default solution and you many need to opt into it. For many folks, sticking to the pre-tax 401k may be the right long-term approach combined with one of the approaches described later in this piece.

Three – Health Savings Accounts (HSA) Contributions

If you have a high-deductible health insurance plan, contributing to an HSA is arguably the best way to save in a tax-efficient manner. That is because contributions (see 2019 limits), not only provide an upfront tax deduction, but they get similar benefits of Roth IRAs with the tax-deferred growth and tax-free distributions.

One planning caveat is that your future HSA distributions need to be allocated towards future medical expenses to get the full tax-free treatment. Another consideration is if you have out-of-pocket medical expenses in the years you’re contributing to an HSA, you would probably want to make those payments with dollars outside of the HSA. That might be counterintuitive for some but remember it’s harder to build up tax-free assets if you’re withdrawing money from them at the same time!

Finally, see if your HSA allows for the money contributed to be invested and what investment choices are available. If all you can do is contribute and keep the proceeds in cash, the benefits are not as great. But you could still participate but wait for a future opportunity to rollover your HSA to a new platform.

Four – Qualified Plan (After-tax) Rollovers

If you have access to a qualified plan (e.g. 401k) that permits after-tax contributions, you could put yourself in a position to transfer those after-tax contributions to a Roth IRA in the future.

In some qualified plans, after you have contributed the maximum pre-tax contributions allowed ($19,000 in 2019 with a $6,000 catch-up over age 50), you may still be permitted to make additional contributions on an after-tax basis.

For example, suppose you’re about to retire from a company with a 401k worth $2 Million, but $400,000 of that is made up of after-tax contributions you’ve made over the years. It is possible now to do direct rollover of that 401k but separate out the $400,000 after-tax amount and the remaining $1.6 Million (pre-tax and growth). The former can be rolled over to a Roth IRA and the latter can be moved to a traditional IRA rollover account. No tax liability is created in the process.

You should be mindful of a couple of pitfalls. It will probably be necessary to rollover the entire 401k account balance at one time. If you’re still working, that might not be feasible unless your plan allows full in-service distributions. Also, 401ks have a special provision that allows distributions as early as age 55 without penalty (compared to age 59 ½ for IRAs). Conversely, newly established Roth IRAs have a 5-year rule to clear before accessing money fully tax-free. If immediate distribution flexibility is desired after retirement, you might not want to dissolve the 401k right away.

Finally, if you own company stock within your 401k, there is a different way to transfer out that stock tax-efficiently with special treatment on the so-called net unrealized appreciation. The key here is that 401k rollovers should be executed with caution and possibly with the guidance of a financial advisor. If the rollover is done correctly, this can be a great way to create a tax-free asset base for the future.

Five – Roth IRA Conversions in Early Retirement

The last few methods we discuss are probably the most strategically interesting, but also require care and diligence. Under the right circumstances, you might get a future tax-free “boost” by doing strategic conversions of existing pre-tax IRAs. A conversion is simply a transfer of assets from one account type to another. Unlike contributions, there are no income limits that prevent conversions to a Roth IRA. The challenge is that a conversion creates an immediate tax liability. As a result, the key is navigating the tradeoff between your current and future tax savings.

The most common way I’ve worked with people to do conversions has been to do them in the first several years of their retirement. This is a time when wage income in usually no longer in the picture, so their potential tax rate has dropped considerably. This is especially true for those who have not reached age 70 ½ when required IRA distributions must begin. This strategy is often helped by those who plan to delay claiming Social Security to their late 60s or as late as age 70.

For those who retire at age 62 and meet the criteria above, that presents a potential 8-year window where the taxes they pay are mostly determined by how much taxable investment income they choose generate themselves!

But how much should you actually convert? The goal is to find a “tax rate equilibrium” that finds a balance between deferring too much or too little income. This piece from Kitces.com describes the theory in more depth. The basic idea is that you spread out conversions over multiple years, so you don’t take an unnecessarily large tax hit in any given one year.

An “equilibrium” example may help. Suppose you don’t do any conversions and your cash flow projections show you will be paying federal taxes in the 24% marginal tax bracket. But your early retirement years project you to be in the 12% marginal tax bracket. One solution is to just convert enough each year that keeps you in that 12% bracket. In today’s tax code for a married couple, that could be potentially up to $60,000 that could be converted in a single year. Different tax brackets will have a different potential range.

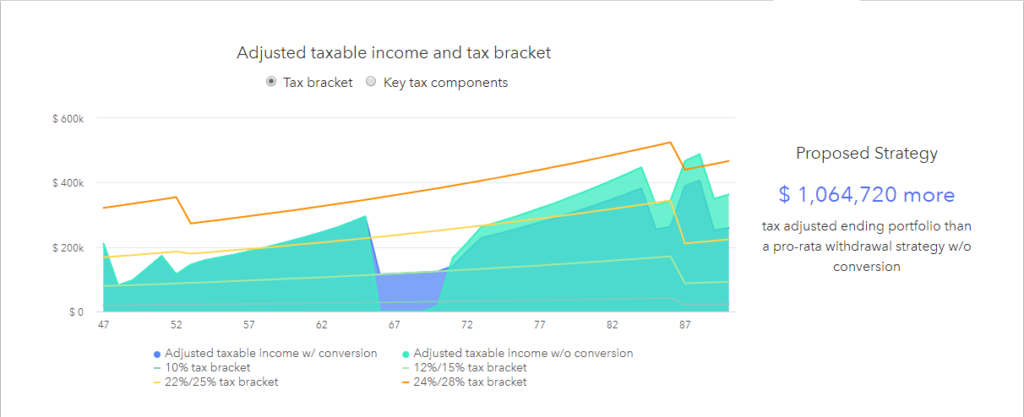

This type of strategy to do smaller Roth conversions annually can make a meaningful difference to a retirement plan. Advisors typically have software to help them recommend specific conversion amounts. For example, this image below comes from the software my firm uses and shows the benefits for a hypothetical client implementing the strategy. It’s important to note that benefits will vary for different households and in some cases, Roth conversions won’t make sense. But in my opinion, this qualifies a “must review” item for most early retirees.

Six – Roth IRA (Opportunistic) Conversions Before Retirement

If you’re not nearing retirement, other opportunities could present themselves in the years ahead. You could find yourself in between jobs or making a transition to start a new business. These would be situations where your earned income will be lower than usual.

Doing a conversion in the year of a job transition is one of my favorite methods. It’s one that people can easily miss possibly due to the stress of being in between jobs or the excitement of potentially paying lower taxes. But it could be an opportunity lost. Like the last example, say you’re normally in the 24% marginal federal tax bracket. Then due to a job transition, your household income for the year projects to put you in the 12% bracket. You could consider making a conversion of enough dollars to “fill up” the 12% tax bracket. Another way to think about this is that our tax brackets are “use it or lose it”.

A similar scenario unfolded for me personally nearly ten years ago when I made a career transition from engineering into financial planning. While my wife and I faced a couple of years of lower household income, we were able to take advantage of it by doing partial Roth IRA conversions.

One caveat here is that if you’re ever in a situation where you have lower than normal wage or business income, the chances you will also need to access money from your savings or investments just to meet living expenses. You might even need to tap your Roth IRAs. To the extent you have enough cash reserves or money that is accessible without penalty (e.g. taxable brokerage account), this strategy can work well for you.

Seven – Non-Deductible IRA Contributions and Subsequent Conversions

Lastly, if you’re a high-income earner, as defined by these limits, you can still make contributions to a traditional IRA. But those contributions would not be deductible. This often defeats the purpose of making contributions to a traditional IRA. But it is possible under the right circumstances to convert such contributions to a Roth IRA while minimizing an adverse tax impact.

This is often called the “backdoor” Roth strategy. If that sounds suspicious, you’re not alone. Advisors used to worry about whether and how to pull this off for clients and while minimizing the risk of an IRS audit. After all, if Roth contributions are not allowed for high income earners, isn’t this just a two-step approach to getting the same result? Fortunately, in 2018 the IRS officially gave the OK to this strategy.

That said, executing this strategy still involves some caution. One of the pitfalls is the so-called “IRA aggregation rule” and how it impacts this strategy is described in this piece by Ed Slott and Co. If you can get by this roadblock, then taking the “backdoor” approach can be a great way to go.

Conclusion

By now you might now be asking: “What percentage of my portfolio should be in tax-free assets?” There’s no single right answer because every household is unique. Time makes a difference too. A strategy for someone with 20 years to retirement could look a lot different than for someone 5 years from retirement.

At the risk of sounding biased, consulting a qualified advisor can help. Above all, I advocate diligence and patience when executing one of the strategies in this piece. Sometimes the best answer is to simply do nothing now and wait until the right circumstances arrive. If this piece has done its job, it has hopefully given you a better framework to think about why and how to create more tax-free assets.

References

- https://bipartisanpolicy.org/report/deficit-tracker/

- https://www.nbcnews.com/business/economy/federal-reserve-cuts-interest-rate-third-time-year-n1073886

- https://www.taxpolicycenter.org/briefing-book/how-did-tax-cuts-and-jobs-act-change-personal-taxes

- https://www.investopedia.com/terms/r/rothira.asp

- https://www.irs.gov/publications/p590b#en_US_2018_publink1000231061

- https://www.irs.gov/retirement-plans/amount-of-roth-ira-contributions-that-you-can-make-for-2019

- https://www.irs.gov/retirement-plans/retirement-plans-faqs-regarding-required-minimum-distributions

- https://en.wikipedia.org/wiki/High-deductible_health_plan

- https://www.shrm.org/resourcesandtools/hr-topics/benefits/pages/2019-hsa-contribution-limits-rise-irs-says.aspx

- http://www.401khelpcenter.com/401k_education/Early_Dist_Options.html#.XcwnXOhKiUk

- https://www.nerdwallet.com/blog/investing/roth-ira-5-year-rules/

- https://www.kitces.com/blog/net-unrealized-appreciation-irs-rules-nua-from-401k-and-esop-plans/

- https://www.kitces.com/blog/tax-rate-equilibrium-for-retirement-taxable-income-liquidations-roth-conversions/

- https://www.irahelp.com/slottreport/irs-official-says-back-door-roth-transactions-are-ok

- https://www.irahelp.com/slottreport/ira-aggregation-rule-easing-rmds-complicating-roth-conversions

The information on this site is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Krishna Wealth Planning LLC (referred to as “KWP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

KWP does not warrant that the information will be free from error. None of the information provided on this website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall KWP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the materials in this site, even if KWP or a KWP authorized representative has been advised of the possibility of such damages.

In no event shall KWP have any liability to you for damages, losses, and causes of action for accessing this site. Information on this website should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.