6-Minute Read

Do you currently work overseas? Perhaps you expect or simply wish to work outside of the US in the future. If so, this piece is geared towards you as an “expat”. Maintaining a financial life that crosses borders introduces many complexities. One of which is planning around taxes. Let’s look at two mechanisms, which if used properly, can provide you significant tax relief as an expat.

Your US Tax Obligations When Working Overseas

Each country has a unique tax system. Most jurisdictions tax based on residency, meaning where you’re permanently located and where you conduct most of your financial activity.

The US is one of the few major developed countries that taxes based on citizenship, not residency. This means worldwide income is subject to tax, no matter where you are living. In fact, the US tax net applies to not only citizens, but also US legal permanent residents (Green Card holders) and anyone considered a US tax resident by means of the so-called Substantial Presence Test.

The good news is even if you are subject to this worldwide tax net, there are mechanisms in place that can provide you relief from double taxation. This piece will cover two of them.

Before diving in, keep in mind that your actual tax obligations are just one part of the story. The other part is staying organized and meeting additional filing requirements. For example, you may have to file tax returns for multiple countries, and these countries don’t always have the same filing deadlines. Also, if you have foreign assets over a certain threshold held in banks and investment accounts, you are likely subject to other reporting requirements.

Expat Tax Tip #1 – The Foreign Tax Credit

What is the Foreign Tax Credit (FTC)?

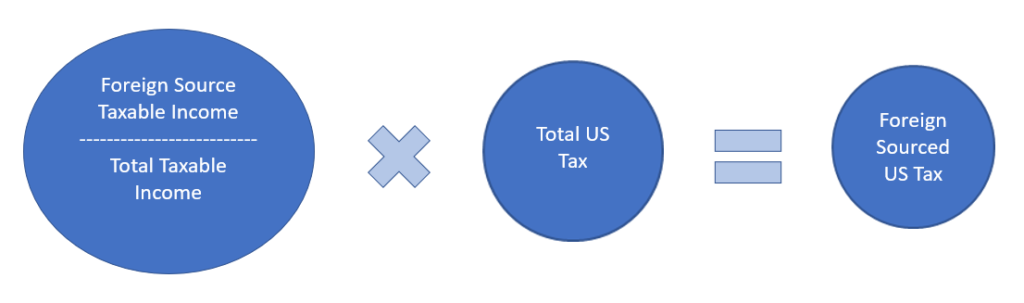

The Foreign Tax Credit, herein referred to as simply the “credit”, allows a dollar-for-dollar reduction in US taxes owed, but only the US taxes based on your foreign source income.

What is foreign source income? Typically, it applies to income you earn while working overseas. But it includes passive and investment income from foreign accounts and rental properties. It also includes dividends received from foreign corporations.

This last point is why you might notice this credit on your tax return even if you’re not an expat. You may simply own some foreign investments in your brokerage account where foreign taxes were automatically withheld when dividends were paid. This credit may help to offset that.

As the image below shows, if you have income that isn’t considered foreign sourced, your resulting foreign sourced US tax (and potential credit) will be scaled proportionately.

Properly Claiming the Foreign Tax Credit

So, this credit looks like it may be a sweet deal, and it can be. But a few criteria must be met to properly claim this credit on your US tax return:

- The tax must be a legal and actual foreign tax liability.

- The tax must be imposed on you as an individual.

- You must have paid or accrued the tax (so it’s not necessarily the same as the tax withheld by the foreign country).

- The tax must be an income tax (or a tax in lieu of an income tax).

If you meet these criteria, aside from some rare exceptions, then you can claim the credit by completing Form 1116. In cases where you’re claiming a low credit amount, this form may not be required with your tax return. Also, care is needed to convert foreign taxes paid to US dollars. There are special exchange rate rules to follow to do this properly.

Finally, if you have foreign taxes that exceed the credit, you can carry back any unused credit 1 year or carry it forward 10 years. This can provide some multi-year tax planning flexibility. Just remember that the credit, even if carried to a different tax year, still can only be used on foreign source income.

Expat Tax Tip #2 – The Foreign Earned Income Exclusion

What is the Foreign Earned Income Exclusion (FEIE)?

For many expats, this next tax tip often works out to be very favorable. The Foreign Earned Income Exclusion, herein referred to as simply the “exclusion”, is a way for expats to exclude earned income from US taxation if that income has already been taxed by a foreign jurisdiction.

It’s important to note that this exclusion cannot be used to offset passive or investment income (unlike the credit discussed earlier). But it can be used for both employment and self-employment income.

If you qualify, the maximum amount you can exclude from earnings is $108,700 (2021 figure – adjusted annually for inflation). Whatever the threshold is for a given tax year, income below that threshold is simply not taxed for US purposes.

What if you earn more than the threshold? In that case the tax treatment is more nuanced. Essentially your tax gets figured using the tax rates that would have applied had you not claimed the exclusion! In other words, the non-excluded income will get taxed at a higher effective rate. It’s still usually a favorable outcome but may catch some people by surprise.

If your employer withholds US tax from your wages you earn abroad, you can submit Form 673 so that they take into account that you expect to qualify for this exclusion.

Properly Claiming the Foreign Earned Income Exclusion

Like the credit discussed earlier, a few criteria must be met to properly claim this exclusion on your US tax return:

- Your tax home is in a foreign country.

- The income is earned in a foreign country. For example, income earned in the US is not eligible even if your employer is in a foreign country. It truly matters where the work was done.

- You meet one of two residency tests:

- Bona Fide Residence Test – You’ve set up a long-term residence in a country and spent at least one calendar year abroad

- Physical Presence Test – 330 days inside foreign country during a continuous 365-day period

If you meet these criteria, aside from some exceptions, then you can claim the exclusion by completing Form 2555.

One notable exception is that if you’re a government employee, it could impact your eligibility. Some other nuances to qualifying if you’re not a US citizen. If you’re not a citizen of a so-called treaty country, you may only be able to qualify based on the physical presence test.

Bonus – The Foreign Housing Exclusion

If you qualify for the foreign earned income exclusion, then you may also qualify for an additional foreign housing exclusion. It would be reported on the same Form 2555.

As you might expect there are rules as to what are considered qualifying housing expenses. It uses a broad “reasonableness” standard. A few examples of what’s included are rent, utilities, insurance, repairs, and parking. Notably mortgage principal payments and any kind of deductible interest payments will NOT count.

Further there are limitations based on the earlier threshold figure for the income exclusion. So, it turns out it’s not a pure additional exclusion. When you go through all the hoops, I estimate it’s an additional exclusion that can go as high as around $15,000 as of 2021.

Which Expat Tax Tip is Better?

Ok, you’ve made it this far and you simply want to know which is better, the credit (FTC) or the exclusion (FEIE)? First realize that the US tax code is designed to prevent “double dipping.” That means you cannot claim two tax benefits on the same income. So, often this really will be an either-or decision. But there are situations when both benefits can be utilized on the same tax return (without double dipping), especially for those exposed to a large foreign tax.

The decision often comes down a tax rate comparison between the US and the foreign country in question. In the US, the current highest marginal tax rate (excluding payroll taxes and state/local taxes) is 37 percent. If you live and work in a country with a higher effective tax rate the more likely you will benefit from taking the credit. Conversely, the lower the tax rate in the foreign country the more you will likely benefit from the exclusion.

For example, I serve a client who is stationed in the middle east with his family. This country effectively has no income tax. In this case, he benefits far more from the exclusion than the credit. Put another way, any exclusion benefits him more than claiming a credit for $0.

With the help of an advisor or tax professional, you can run the numbers both ways and choose which path saves you the most in taxes or creates the most carryover credits to possibly utilize in the future.

Tax Planning When Overseas Can Be Complex

Believe it or not. This piece has only been a primer to two strategies available to help expats reduce their tax liability. Here are some other caveats:

- Special reporting requirements, nuances and exceptions have not been covered in this piece.

- Switching between the methods described here in different tax years can create other complexities and costs.

- Other deductions and credits you might ordinarily take could be impacted by the extent you take advantage of these expat tax breaks.

- It remains to be seen if any significant changes will come to these strategies in the Biden Administration.

Not surprisingly, this is an area of the tax code that can get quite complex. It is often necessary to consult a qualified advisor or tax professional. If you are a current or potential expat, I hope this piece can help you build the foundation for your overall cross-border tax plan and start asking the right questions.

If you have comments or questions on this piece, please drop me a line at: [email protected]

References

- https://www.irs.gov/individuals/international-taxpayers/substantial-presence-test

- https://www.irs.gov/businesses/comparison-of-form-8938-and-fbar-requirements

- https://www.irs.gov/individuals/international-taxpayers/foreign-tax-credit

- https://www.irs.gov/forms-pubs/about-form-1116

- https://www.irs.gov/individuals/international-taxpayers/foreign-earned-income-exclusion

- https://www.irs.gov/pub/irs-pdf/f673.pdf

- https://www.irs.gov/individuals/international-taxpayers/foreign-earned-income-exclusion-bona-fide-residence-test

- https://www.irs.gov/individuals/international-taxpayers/foreign-earned-income-exclusion-physical-presence-test

- https://www.irs.gov/forms-pubs/about-form-2555

- https://www.irs.gov/individuals/international-taxpayers/foreign-housing-exclusion-or-deduction

- https://krishnawealth.com/tax-changes-to-expect-during-the-biden-administration/

The information on this site is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Krishna Wealth Planning LLC (referred to as “KWP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

KWP does not warrant that the information will be free from error. None of the information provided on this website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall KWP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the materials in this site, even if KWP or a KWP authorized representative has been advised of the possibility of such damages.

In no event shall KWP have any liability to you for damages, losses, and causes of action for accessing this site. Information on this website should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.