8-Minute Read

“There is scarcely any point in the economy of national affairs of greater moment than the uniform preservation of the intrinsic value of the money unit.”

-Alexander Hamilton (Report on the Mint – 1791)

As the country continues to recover economically from the pandemic, you may be seeing more commentary on the news about inflation. You might also be noticing changes in your own spending such as higher costs for housing, food, and energy. Combine this with a supportive policy environment, both monetary and fiscal, fears of inflation naturally come to the surface.

In this piece we provide some perspective on inflation and then look at some of the solutions available to you as an investor to overcome it.

Understanding Inflation

What is Inflation?

Inflation is the erosion of your purchasing power. When the prices of goods and services increase over time, you as a consumer can buy fewer of them with each dollar. Put another way; the value of each dollar you have will tend to decline over time.

You likely have many different reasons to invest, but this may be the most practical reason why you’re investing in the first place. It is simply to keep pace with the persistent effects of inflation and thereby maintain your standard of living.

Inflation can “Milk” you Slowly

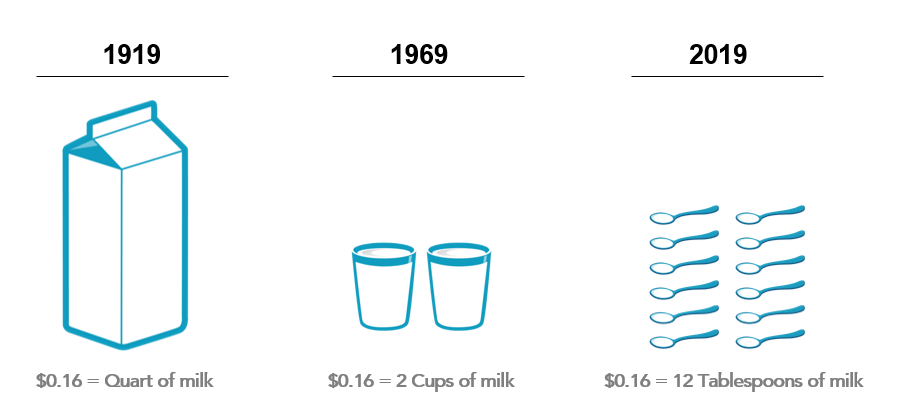

It can be a slow burn though. It may take many years before you even notice the effects of inflation. When I discuss the inflation topic, I often refer to this visual below from Dimensional Fund Advisors about the price of milk.

In 1918, 16 cents would buy one quart of milk. Fifty years later, it would buy only two cups of milk. One hundred years later, it would buy around 12 tablespoons of milk. I personally prefer soy or oat milk, but hopefully this reinforces the idea that your money today will likely buy less tomorrow.

For those who live primarily on a fixed income, especially those without inflation adjustments (e.g., certain pensions and annuities), this phenomenon of inflation becomes the central focus for maintaining a quality living standard. Notably, Social Security income provides annual cost of living adjustments.

What causes Inflation?

This is a surprisingly difficult question to answer. In theory, it should occur when too much money is chasing too few goods in an economy. But in practice, it’s far more complex with many intermingled factors. As a result, inflation may not arrive when you think it should and vice versa.

A Nobel laureate in economics, Eugene Fama, often says in his interviews that he has no idea what causes inflation. He’s probably being humble to some extent, but I believe it’s a genuine admission. Mr. Fama also recently commented on the challenges of predicting inflation and wisely observed that inflation tends highly persistent once you get it (either to the upside or downside).

Even the prolific Alexander Hamilton, per the opening quote of this piece, was concerned about inflation in the late 18th century at the time of establishing the first U.S. Central Bank and Mint. Part of the solution at that time was to tie the money supply to known quantities of gold and silver coins.

Such a solution is not available or practical for today’s Federal Reserve bank. For what it’s worth, the “Fed” (at the time of this writing) is not overly concerned about inflation. They are attributing some of the recent price surges to supply chain issues that may be temporary and transitory. The Fed plans to hold short-term interest rates lower for now and likely won’t make policy adjustments until certain measures are reached, such as higher levels of employment and economic growth. Stay tuned.

The Real Villain – Unexpected Inflation

As the title of this piece suggests, I’m in the camp of always having a healthy fear about inflation. Yet it’s not just inflation itself that is the worry, but it’s unexpected inflation. Keep in mind that the markets for stocks and bonds are continually pricing in the risk of inflation. At the time of this writing, that market expectation is around 2.6% if we look at spreads between regular and inflation-adjusted government bonds.

If this expectation plays out, prices over the coming years will rise a bit faster than they have compared to the past decade where it ran around 1.7% (2011 to 2020). However, this is also far from the worst sustained inflationary level that was last seen in the US in the 1970s and early 1980s. At that time inflation ran at a whopping 8.7% (1973 to 1982).

Could that history repeat itself and we see the return of so-called hyperinflation? Anything’s possible. If inflation turns out to be higher than what is collectively expected, markets will adjust, and asset prices will correct. But therein lies the challenge. Unexpected inflation is…well, unexpected. What can you do as an investor?

Overcoming Inflation

Equities as the Workhorse

Generally, equities (stocks) are a good hedge against inflation and perform well under moderate inflationary environments. On one hand, inflation hurts companies because of the (likely) resulting rising interest rates and increased input costs. But companies ultimately tend to retain their pricing power, pass along higher costs to consumers, and maintain profitability despite inflation.

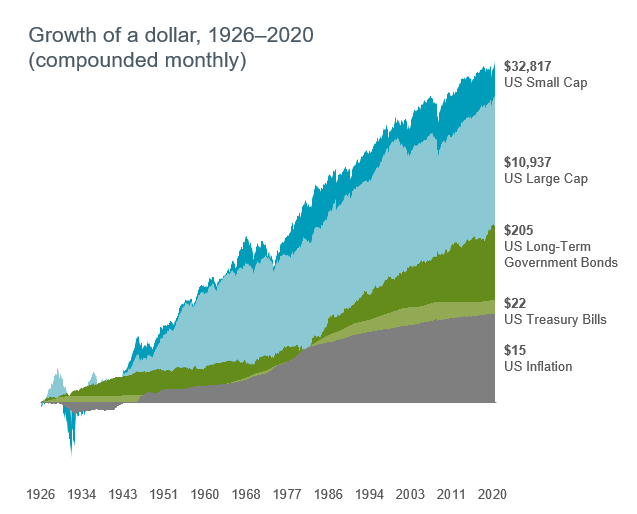

Consider this growth of wealth graph below, also courtesy of Dimensional Fund Advisors. The good news here is that capital markets have rewarded long-term investors. US stocks, as shown in the two blue colors, have created real (after-inflation) wealth over time.

Investors can also consider international stocks. While generally underperforming their US counterparts in recent years, they can provide diversification benefits and offer some protection should the US dollar weaken against other global currencies. As currencies don’t move in lock step with each other, an argument can be made that US domiciled investors can mitigate some US dollar inflation risk when investing internationally. There are other valuation-based reasons to consider investing internationally too.

The Challenge of Bonds and Cash

Bonds and cash can struggle in an inflationary environment. For example, treasury bills (T-bills) have never had a year with a negative nominal return but have had many periods when they haven’t kept up with inflation (negative real return).

In the graph above, you’ll notice that T-bills have barely covered inflation over the long haul. Long term government bonds have done better but come with more volatility and sensitivity to interest rates.

However, bonds and cash can still serve a purpose. They tend to be particularly good in deflationary environments. They can also be effective diversifiers against equity risk.

One of the challenges of investing is deciding how much to allocate to low volatility assets such as government bonds and cash. Several factors such as your short-term spending needs come into play. Psychologically with these kinds of assets, you may feel safer not seeing the price of your investment fluctuate. But this comfort may need to be balanced against the risk that your purchasing power could deteriorate over time.

Treasury Inflation-Protected Securities (TIPS)

Available since the late 1990s, TIPS are guaranteed by the US Treasury just like traditional securities such as T-bills. Likewise, they are considered by the marketplace to have low risk of default. TIPS are issued with a variety of maturities, and there’s a large, liquid market for buying and selling them.

Unlike T-bills and traditional bonds, TIPS are indexed to inflation to protect investors from an erosion in purchasing power. As inflation (measured by the consumer price index) rises, so does the par value of TIPS, while the interest rate remains fixed on any individual TIPS bond purchased. If inflation unexpectedly rises, the purchasing power of any principal invested in TIPS should also increase.

Disclosure: For diversified exposure to TIPS, I typically utilize DFA Inflation Protected Securities in client accounts at Krishna Wealth Planning.

TIPS can be effective for risk management, but setting proper expectations is important. Presently the yield on 5-year duration TIPS bonds is around negative 1.8%. This means that if no inflation materializes while you’re holding the bond, you will lose money. Conversely, you would need inflation to be around 2.6% to get to get the same result as investing in a 5-year duration regular treasury bond.

Series I Savings Bonds

For those who are relatively lower earners or have less to invest, the “I Bond” could be a compelling solution. Jason Zweig at the Wall Street Journal recently provided a overview in The Safe, High-Return Trade Hiding in Plain Sight.

I Bonds must be purchased directly from the US Government. Here are a few notable points:

- The current interest rate is 3.54% (through October 2021). This is comprised of a fixed rate (currently 0.00%) and an inflation rate (1.77% adjusting semi-annually). This inflation rate can decrease all the way to 0% but not below it.

- Maximum purchase is $10,000 per year per account holder.

- Bond duration is 30 years, but you can redeem after one year. If redemptions are made before five years you will forfeit the previous 3 months of interest.

- Subject to federal income tax, but not most state and local income taxes.

Other Ways to Attempt Inflation Hedging

Finally, there are other ways investors may attempt to hedge against inflation. While not a deep dive, here’s a brief look at a few options available:

- Commodities & Precious Metals – This includes gold, oil, natural gas, wheat, soybeans, coffee etc. These do not provide cash flows to investors in the form of dividends or interest unlike the solutions above. But they are often treated in the marketplace as hedges against inflation or equity risk.

- Real Estate – Rents and real estate prices tend to rise during periods of inflation. If you’re in the market for buying a home now, you’re probably experiencing this effect firsthand.

- Fixed Rate Debt – Such as mortgages for personal, rental and business properties, these have a different set of risks to you as a borrower. But they can benefit during periods of inflation as you’re paying off debt with cheaper dollars. Conversely, the lender is bearing the inflation risk.

- Cryptocurrencies – Supposedly the modern version of inflation hedging. Not yet recommended by this advisor for reasons too long to articulate here. If this area interests you, proceed delicately.

- Inflation Swaps – Typically for advanced traders and institutions, these are contracts used to transfer inflation risk from one party to another. In practice, I often see them utilized within larger bond mutual funds to add a layer of inflation protection on corporate bonds that are not offered with such protection directly.

I’ll end this section with a word of caution from my colleague, Daniel Yerger, in his recent piece, Inflation and You. “…understand that there is no guarantee that an asset will smoothly reprice its value to reflect inflationary pressures, and that many inflation hedging assets are still ultra-volatile.”

Finding Your Healthy Fear of Inflation

It’s like the subtitle to the 1960s film Dr. Strangelove: “How I Learned to Stop Worrying and Love the Bomb.” In this case, inflation is the proverbial bomb. Let’s face it. Inflation is one of the biggest headwinds to face over your investment lifetime. If you’re making a list, you might add taxes, fees and managing your own behavior.

Yet life is too short to worry about forces outside of your control. As an investor, perhaps a productive middle ground is to always have a healthy fear of inflation. You then work to combine the right mix of growth and risk management assets in your portfolio, based on your unique goals and needs. Hopefully, you can then mitigate the effects of inflation over time, grow your wealth and ultimately have that wealth serve you.

If you have comments or questions on this piece, please drop me a line at: [email protected]

References

- https://www.ssa.gov/cola/

- https://www.dimensional.com/us-en/insights/inflation-an-exchange-between-eugene-fama-and-david-booth

- https://www.wsj.com/articles/inflation-in-rich-countries-hit-a-12-year-high-in-april-11622637522?mod=searchresults_pos1&page=1

- https://krishnawealth.com/two-decades-one-timeless-investment-lesson/

- https://www.morningstar.com/funds/xnas/dipsx/portfolio

- https://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield

- https://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yield

- https://www.wsj.com/articles/i-bonds-the-safe-high-return-trade-hiding-in-plain-sight-11622213324?mod=djintinvestor_t

- https://www.treasurydirect.gov/indiv/research/indepth/ibonds/res_ibonds.htm

- https://www.mywealthplanners.com/2021/05/18/inflation-and-you/

The information on this site is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Krishna Wealth Planning LLC (referred to as “KWP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

KWP does not warrant that the information will be free from error. None of the information provided on this website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall KWP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the materials in this site, even if KWP or a KWP authorized representative has been advised of the possibility of such damages.

In no event shall KWP have any liability to you for damages, losses, and causes of action for accessing this site. Information on this website should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.