5-Minute Read

Social Security income can play a meaningful role in your retirement planning. I’ve found that getting accurate figures is more challenging than you might think.

The first step is easy. Download a benefits statement online from your My Social Security account. If you’ve never done this before, you will have to create an account first. The statement you access will have information including your past earnings history and an estimate of your future Social Security benefits.

While often useful, I’ve also seen situations when the statement can be misleading. This happens when the Social Security administration reads too much or too little into your past earnings history. As a result, they will either overstate or understate what you project to receive. They don’t quite have your story straight.

In this piece, we look at a case study to give you an idea of the variability involved here. We also provide tips for how you can correct this in your financial plan.

Social Security Scenarios

As we dive in, you might refer to our earlier blog, The Top Four Questions I’m Asked About Social Security. There we provided some fundamentals on how to estimate and optimize your benefits. We also included thoughts on the long-term viability of the Social Security system. In this piece, the goal is more focused. It is simply to help you get an accurate figure for your financial plan.

Aside from structural changes to the Social Security system itself, you could have a range of potential outcomes for your own Social Security benefits.

To see why, let’s look at an example. Meet Kiara. She’s age 44 and is expected to earn $100,000 in wages this year. She has worked for the past 22 years starting at $35,000 wages after college and getting roughly 5 percent pay increases each year. If she were to work until her “full retirement age” of 67, she would now be roughly halfway through her career.

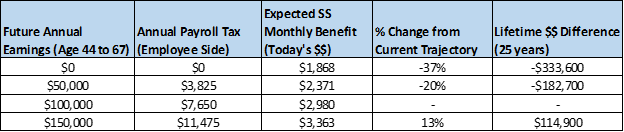

Life changes though. What happens to Kiara’s Social Security if her earnings trajectory were to change dramatically to the downside or upside? We’ll explore through four scenarios modeled with tools developed in our practice. The figures you’ll see may not exactly reflect assumptions used by the Social Security Administration. But it should serve well to educate and illustrate how all this works.

One – Kiara Stops Working Outright

Perhaps Kiara stops working due to family or health reasons. Maybe she’s married and her spouse is expected to work instead. By not working, I simply mean she is no longer earning wages or business income. As a result, she is no longer paying into the system with payroll taxes.

In this case, I estimate Kiara can expect a future Social Security benefit of $1,868 per month at age 67. I state this in today’s dollars as well as the figures in the rest of this blog.

Despite stopping work, notably Kiara is still eligible for some benefits. Why? The Social Security rules require that you work for at least 10 years in the past and pay at least 40 quarters of payroll taxes. She already meets those criteria.

Two – Kiara Gets on a Lower Current Earnings Trajectory

What if instead of outright stopping work, she cuts back and earns half as much. That would be $50,000 annual earnings instead of $100,000. Assuming she stayed on that trajectory from now until retirement, I estimate Kiara can expected a future Social Security benefit of around $2,371 per month.

Three – Kiara Stays on her Current Earnings Trajectory

Scenario three is the base case. It just assumes Kiara stays on her current earnings trajectory. She would have $100,000 of inflation adjusted income from now until retirement.

In this case, I estimate Kiara can expect a future Social Security benefit of around $2,980 per month. If she were to download a benefits statement today, it would likely show an amount very close to this.

If you expect your future earnings to be similar to the recent past, your Social Security statement should provide a reliable estimate for your planning.

Four – Kiara Gets on Higher Earnings Trajectory

Finally, imagine in this scenario that Kiara gets a significant promotion. She now finds herself on a higher earnings path of $150,000 per year and stays on that trajectory until retirement.

For this illustration, I purposely chose the figure of $150,000. It happens to be very close to the current Social Security wage cap ($160,200 for 2023). This wage cap is important because it determines the amount of payroll taxes you pay and how much gets counted towards your future benefits.

In this case, Kiara can expect a future Social Security benefit of around $3,363 per month.

Notably if you expect to earn far more than the wage cap, your own Social Security benefits may not be too much higher than this.

These results tell us a few things. First is that the range of potential outcomes here can be quite big. It is almost $1,500 per month swing from the worst-case to the best-case scenario. If Social Security were received for 25 years, there’s a potential lifetime difference of nearly $450,000.

You might also pay attention to the final columns showing the changes from Kiara’s current trajectory. There’s a bit of “nonlinear” effect going on. Reduced earnings lead to a somewhat proportional reduction in future benefits, which might be intuitively what you would expect.

However, getting on the higher income trajectory doesn’t do as much. Despite paying 50 percent higher payroll taxes (on the extra $50,000 of income) for the rest of her career, Kiara can only expect an additional $383 per month in benefits. I’ll reiterate we’re dealing with present dollar figures here.

The reason this happens is that Social Security is considered a regressive scheme. Yes, if you earn more, you will get more benefits. But the increase in benefits happens at a declining rate. You get a higher income replacement rate on the first dollars you earn. But if you’re a high-income earner, you get a lower replacement rate.

Technically, higher earners eventually only get credited at a 15% rate based on the formulas involved. And remember, nothing gets counted above the wage cap (~$160K for 2023). Another way to put all this: Social Security replaces a lower percentage of your working years income the more you earn.

Your Next Actions

As the title of this piece suggests, your Social Security benefits statement may not tell the full story. If you expect your future wage or business income to be different than what has been most recently recorded on your statement, you may want to take a few extra steps for your planning.

In practice, I’ve noticed this to be a more important consideration if you’re getting on a lower income trajectory instead of a higher one. Typically, the more dramatic your earnings changes are, the more impact you will see. But there are many variables. Every situation is a bit unique and worth reviewing.

As your next step, first talk to your financial planner. He or she should have the tools to help you sort all this out and ensure your retirement income projection is accurate. The complexity increases if you’re married and dealing with interplay of spousal benefits.

Another option if you would like to explore this on your own is to visit the online calculator from ssa.gov. This assumes you’ve already downloaded your most recent statement as noted earlier. It takes a few minutes to properly enter all your past earnings and future expected earnings. Some care is needed to interpret the results, but this can provide a reasonably good estimate of your future benefits.

If you have comments or questions on this piece, please drop me a line at: [email protected]

References

- https://www.ssa.gov/myaccount/

- https://krishnawealth.com/the-top-four-questions-im-asked-about-social-security/

- https://www.ssa.gov/oact/cola/cbb.html#:~:text=We%20call%20this%20annual%20limit,2023%2C%20this%20base%20is%20%24160%2C200.

- https://www.ssa.gov/benefits/retirement/planner/AnypiaApplet.html

The information on this site is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Krishna Wealth Planning LLC (referred to as “KWP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

KWP does not warrant that the information will be free from error. None of the information provided on this website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall KWP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the materials in this site, even if KWP or a KWP authorized representative has been advised of the possibility of such damages.

In no event shall KWP have any liability to you for damages, losses, and causes of action for accessing this site. Information on this website should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.