12-Minute Read

By now you may have heard that a new bill that was recently passed into law. It’s called “Setting Every Community Up for Retirement Enhancement Act”, or aptly known as the SECURE Act. This bill included several provisions that can positively impact retirement savers. This piece takes a closer look at one of the key items taken away as part SECURE Act. That is the ability for certain heirs of retirement accounts to “stretch” distributions over their lifetimes. We’ll see why that’s important by first providing a brief overview to the changes made to the inherited account rules. Then we’ll look at some strategies you and your heirs can take to mitigate the impact.

Changes to the Inherited Account Rules in the SECURE Act

While there were numerous retirement related changes in the SECURE Act, below is an overview of the key changes affecting inherited accounts. We’ll defined these as any retirement accounts classified as either defined contribution plans (e.g. 401k, 403b plans) or individual retirement accounts (e.g. Traditional IRAs, Roth IRAs).

- Many heirs of retirement accounts (with some exceptions below) will have to withdraw the assets completely within 10 years, rather than having the option to stretch those distributions over their life expectancies. This change is intended to help raise tax revenue over the next decade to offset other areas in the new spending bill.

- The law takes effect for deaths of retirement account owners after 31st, 2019. This means accounts inherited before then can still benefit from the prior law which allowed stretched distributions.

- This law change can present a challenge to those who have previously engaged in generational tax planning and other strategies to create tax-efficient, lifetime income sources for their children or grandchildren. All else equal, stretching inherited distributions allows the potential for more tax-deferred growth and less overall tax impact for heirs. Condensing to 10 years reduces those benefits.

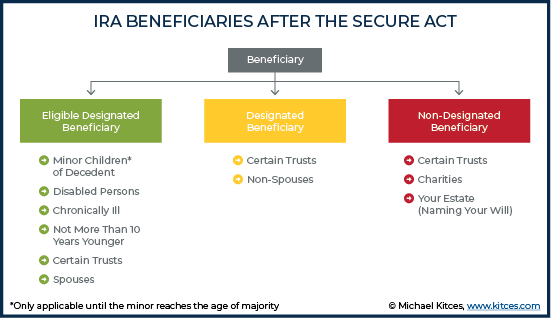

- There are some notable exceptions. Jeffrey Levine, in a comprehensive piece on the SECURE Act, produced this following list of “Eligible Designated Beneficiaries” who can still take inherited distributions according to the previous rules. This is also visually shown in the image below from Kitces.com.

- Spousal beneficiaries

- Disabled (as defined by IRC Section 72(m)(7)) beneficiaries

- Chronically ill (as defined by IRC Section 7702B(c)(2), with limited exception) beneficiaries

- Individuals who are not more than 10 years younger than the decedent

- Certain minor children (of the original retirement account owner), but only until they reach the age of majority. This age varies in some states but is usually 18.

Estate and Tax Planning Strategies to Consider

As with many law changes like the one described above, opportunities arise to revisit and revise planning strategies. Yet not every law change requires a reaction. One can argue that having ten years to distribute inherited assets is still a reasonably long distribution period. But one or more of the suggestions to follow could help improve your plan and be appropriate next steps to take.

One – Review and Update Beneficiary Designations

Even if no material changes are required in your plan as a result of SECURE Act, one next step might be worth considering. That is simply reviewing and updating the beneficiary designations on your retirement accounts. A few tips:

- If you’re married, naming your spouse as beneficiary still retains the same benefit prior to the law change. Recall spouses are one of the exceptions noted in the previous section. For example, a surviving widow can still stretch IRA distributions for the rest of her lifetime on an account owned by her deceased husband.

- Another idea is splitting beneficiaries among multiple people if that makes sense in your situation. The idea here is if retirement assets are split between a larger number of people (e.g. children, grandchildren), you reduce the likelihood of those beneficiaries experiencing a severe adverse tax impact down the road. Their required minimum distributions would simply be smaller.

- If younger children are involved, then you may need to have a trust named at some level as a beneficiary of your retirement account(s). Some implications of that are noted in the next section.

- If you’re charitably inclined, naming one or more charities as partial or contingent beneficiaries can be considered. In this case, neither you nor your heirs will pay income taxes on the assets given to charity by beneficiary designation. Furthermore, the receiving charity doesn’t pay income taxes either so they can receive the full benefit of your gift.

Two – Review and Possibly Update Trusts

If you have named a trust at some level as a beneficiary of your retirement accounts, you may need to review the language of the trust. The goal is to ensure it is still compatible with the way you would like assets distributed to the beneficiaries named in the trust.

There can be several reasons to have a trust named as beneficiary of your retirement accounts instead of directly naming an individual. A common situation is having young children that can’t and shouldn’t directly receive financial assets. Even young adults may not have the financial discipline to receive full and immediate access to a large inheritance. Disabled beneficiaries may need to have special trusts in the picture to ensure their security and not jeopardize any governmental aid. An overarching reason to have a trust is to provide asset protection to your heirs from creditors.

Trusts can get complicated. Generally, a beneficiary of a trust could still benefit from the “stretch” provisions if the trust was drafted properly. These are often called “conduit” trusts where the retirement account distributions flow to the trust and the trustee distributes the proceeds to the beneficiary. If this new 10-year rule from the SECURE Act causes the distribution of assets to your heirs much faster than what you intended, then changes may be warranted.

As noted in this piece from the National Law Review, a possible alternative is using an “accumulation” trust. This allows the trustee the flexibility to retain retirement account distributions in the trust instead of paying them directly out to the beneficiary. Going in this direction does require some tradeoffs. You’re balancing asset protection versus adverse income taxes because trusts are taxed at higher rates than individuals.

Some other interesting approaches are noted by Martin Shenkman in this Forbes piece. His ideas include revamping your trust strategy altogether or using charitable remainder trusts in the plan. These are advanced solutions but could be worth considering with your financial advisor and estate attorney.

All this said, running out and making changes to your trust may not be needed right away. As this law change is still fresh at the time of this writing, future guidance from the IRS might be coming. That could help address ambiguities between what your trust language says and what the federal law requires. If you’re drafting new trusts for the first time, then it’s a good opportunity to ensure it’s compatible with the latest laws.

Three – Consider Life Insurance for Wealth Transfer

Whether this was truly by design or not, the new law seems to favor life insurance over IRAs as a more tax-efficient way to transfer wealth.

This isn’t a call to run out and buy life insurance. But depending on your age, health and financial circumstances, life insurance could be intriguing. In many cases, the benefits paid out by life insurance can have minimal to no income or estate tax consequences.

Due diligence is always needed before purchasing a life insurance policy. While we won’t dive deep in this piece, here are some considerations:

- Does your age and current health status make it cost effective to buy life insurance in the first place?

- What type of policy should you buy? While I most often recommend term life insurance policies, those might not be appropriate for the type of risk we’re addressing in this piece. Permanent life insurance may be a better fit. Rebecca Lake provides a brief comparison of the two approaches in this piece.

- How much death benefit do you want and need for your heirs?

- Should you own the life insurance policy in your own name or within a trust?

- Do you have enough after-tax assets to handle the required premiums of the policy? If not, is it viable to withdraw assets from your pre-tax retirement accounts, pay the taxes (and possibly penalties) and then use the proceeds to purchase life insurance?

- Are the assets you commit to a life insurance policy not going to be needed for the rest of your life?

- Do you understand the fees involved with the insurance product you’re considering and whether the insurance company you use is in strong financial condition?

Note: Krishna Wealth Planning does not sell life insurance products and serves as a fee-only financial advisor. We do work with various insurance partners and carriers to help identify appropriate insurance solutions for clients. We recommend working with a financial advisor along with a licensed insurance agent to review your insurance needs.

Four – Adjust Your Retirement Withdrawal and Gifting Strategies

Retirement withdrawal strategies vary for each household based on a variety of unique circumstances. The general goal is to withdraw money in such a way that attempts to minimize lifetime tax payments to the extent the law allows it. If your current strategy is to let your retirement accounts accumulate while doing the bulk of your spending from taxable accounts, then a strategy shift might be necessary due to the SECURE Act.

Assets in taxable accounts can be transferred to heirs in a tax efficient manner. Heirs can (at the time of this writing) still receive what’s called a step-up in cost basis. This simply means that taxable accounts may be more efficient from a tax perspective to pass along to heirs than retirement accounts.

We already mentioned earlier that naming one or more charities as beneficiary of an IRA could be worth considering. As for charitable gifts during lifetime, changes might be warranted too. Your approach might have been to donate appreciated securities from your taxable account. That’s often the most tax-efficient way to make charitable donations. Conversely, for those over the age of 70 ½, you could also consider qualified charitable contributions, or QCDs. This is another way to spend down retirement accounts relative to taxable accounts while still retaining some of the tax benefits of making charitable gifts.

Five – Revisit Your Roth IRA Conversion Strategy

The new law changes could impact the way you think about your Roth IRA conversion strategy moving forward. For more background, I discuss this strategy in more depth in an earlier piece Seven Ways to Maximize Your Tax-Free Assets.

Roth conversions can still be a viable strategy for saving taxes during your lifetime. But if you’re doing conversions also for the benefit of your heirs, then some additional nuances come into play.

Notably the legislation does not require inherited distributions to be done on an annual basis. For example, an heir of a Roth IRA could postpone payouts until near the end of the 10-year window in an attempt maximize tax-free growth. The ultimate distribution at the 10-year mark (typically tax-free), if not spent, could be reinvested but possibly then subject to annual taxation depending on where and how that reinvestment occurs.

Conversely, if distributions from an inherited traditional IRA were delayed for 10 years, the problem could be triggering one year in a very high tax bracket subjecting that distribution to large taxes that might have been avoided under a more gradual distribution strategy.

With these last few points in mind, we can generalize as follows:

- You might want to become more aggressive with your Roth conversion strategy if you expect your heirs to be in a higher tax bracket when they inherit. Put another way, you would be giving your heirs less taxable income that they might not even need.

- If you expect your heirs to be in a lower tax bracket, you could look at less aggressive Roth conversion approach if that still fits well with your own lifetime goals and tax situation.

A qualified financial advisor could help you fine tune an approach and model different conversion scenarios.

Six – Plan the Timing of Your Distributions (for those who inherit)

This last strategy views it from the perspective of a person receiving the inheritance. Starting here in the year 2020, if you directly inherit a retirement account (from a non-spouse), you may be faced with some critical decisions.

- If you’re an “older” inheritor, say on the verge of retiring, you might not want to make any distributions from an inherited account in the years where you still have earned income. If you are in your highest earnings years, you likely wouldn’t want or need to create additional taxable income from inherited account distributions. In most circumstances, you would face paying an unnecessarily high tax bill. If you waited until you retire, you could use the inherited account as your main or supplemental income source in those early years of retirement. You just want to make sure the account is depleted by the end of the 10-year window.

- If you’re a “younger” inheritor, you might look at the situation differently. You may be considering job changes, new educational pursuits or starting a new business. These situations among many others could create a period of years where inherited account distributions would be very valuable. It could be wise to make most, if not all, of the distributions within the first few years of inheriting.

The main idea here is if you’re a beneficiary, try to control the timing of your distributions to the extent you can. Having ten years to work with could provide you ample opportunities to strategically deplete your inherited assets.

Concluding Thoughts

For many folks, including financial advisors, the changes to the inherited account rules from SECURE Act do come as a surprise. But this is a good reminder that there is always a legislative risk component to the decisions we make around tax and estate planning. We need to acknowledge that law changes can reduce, if not outright nullify, the benefits of strategies we put into place in the past. We must always be prepared to adapt, a skill that goes well beyond the narrow realm of financial planning discussed here.

If you have comments or questions on this piece, please drop me a line at: [email protected]

References

- https://www.congress.gov/bill/116th-congress/house-bill/1994

- https://www.kitces.com/blog/secure-act-2019-stretch-ira-rmd-effective-date-mep-auto-enrollment/

- https://www.law.cornell.edu/uscode/text/26/72

- https://www.law.cornell.edu/uscode/text/26/7702B

- https://www.natlawreview.com/article/secure-act-trust-planning-inherited-iras

- https://smartasset.com/life-insurance/permanent-vs-term-life-insurance-which-do-you-need

- https://www.napfa.org/financial-planning/what-is-fee-only-advising

- https://www.investopedia.com/terms/s/stepupinbasis.asp

- https://www.kitces.com/blog/qualified-charitable-distribution-qcd-from-ira-to-satisfy-rmd-rules-and-requirements/

- https://krishnawealth.com/seven-ways-to-maximize-your-tax-free-assets/

The information on this site is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Krishna Wealth Planning LLC (referred to as “KWP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

KWP does not warrant that the information will be free from error. None of the information provided on this website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall KWP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the materials in this site, even if KWP or a KWP authorized representative has been advised of the possibility of such damages.

In no event shall KWP have any liability to you for damages, losses, and causes of action for accessing this site. Information on this website should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.