15-Minute Read

“Everything should be made as simple as possible, but not simpler.”

– Albert Einstein

Small business owners face daily challenges and competing priorities. It is no surprise that implementing a retirement savings plan can be put off or outright neglected. Yet having the right plan can help efficiently build wealth for both owners and their employees. This piece looks at the “simpler” plans small business owners could adopt with minimal disruption to daily operations. There are still several nuances to consider which we’ll explore here to help you make an informed decision.

What Factors to Consider?

Asking yourself these questions can help as you start to consider the possibilities:

- How much are you capable of saving every year?

- How much flexibility do you need in making contributions to a plan? Some businesses are more cyclical than others and it may not be practical to make the same level of contributions every year.

- How much are you looking to incentivize and retain employees?

Before Jumping In

While this piece looks at the truly simpler options available to small business owners, these are not the only options worth considering. 401(k) plans and defined benefit plans would be in the next tier. They are more complex to administer while carrying higher startup and operating costs. However, under the right circumstances, the benefits can outweigh the costs.

Three solutions are discussed in this piece. In some cases, they can be mixed and matched, as you’ll see in some examples at the end. They can be considered for any small business owner regardless of how the business is structured (sole proprietorship, partnership, LLC, C Corp, S Corp). When implementing, investment accounts can also be opened at variety of different financial institutions. If you make contributions to plan on behalf of your employees, those can be treated as tax deductible business expenses.

One – Skip the Formal Plan – Use Traditional/Roth IRAs and Brokerage Accounts

Let’s first look at what is often the default option for small business owners. That is simply not adopting a formal retirement plan in the first place! This could be the most practical solution for new business owners or those not at a stage where they need to incentivize employees. Here are three common account types used in lieu of a formal plan:

Traditional Individual Retirement Arrangements (IRAs)

There is a lengthy list of rules to how an IRA can be funded and operated. This can be found in IRS Publication 590. But let’s cover some of the practical requirements for a small business owner.

- You can make contributions to an IRA if you (or your spouse if filing a joint return) have taxable compensation for the year and you do not reach age 70 ½ by the end of year. For a small business owner, compensation is defined as net earnings from the business reduced by contributions made on your behalf to retirement plan and deduction for the deductible part of your self-employment taxes.

- You can contribute in 2019 up to $6,000 ($7,000 if you’re age 50 or older) or if it is a lesser amount, your taxable compensation for the year.

- Money contributed to a traditional IRA will typically lower your taxable income and help you pay less taxes in the year of the contribution. Your tax deduction could be limited if you or your spouse has access to a qualified retirement plan at work and your taxable income is above certain limits. If you are affected by these limits, you can still make non-deductible contributions to an IRA which can make sense in some circumstances.

The main benefits to using a Traditional IRA are that you (likely) get a tax deduction for the year of your contribution and your investments can grow tax deferred over the subsequent years. At the time of distribution, most if not all of what you withdraw will be taxed as ordinary income.

Roth IRAs

Many of the rules above for a Traditional IRA also apply to a Roth IRA. Some of the notable differences are:

- There is no upfront tax benefit (deduction) for the contributions you make. But as long as you meet certain requirements, distributions from Roth IRAs will be tax-free in the future.

- There are no age limits to when you can contribute and in the current law, there are no required distributions after reaching age 70 ½.

- There are limits to your contributions based on your household income. Also, the dollar limits noted for Traditional IRAs apply to all IRAs. For example, if you’re under age 50 and meet the other requirements, you can make a $6,000 contribution to either a traditional IRA or a Roth IRA, but not both.

The appeal to Roth IRAs is the potential for creating a tax-free income source in the future. Even without knowing if you will be exposed to a higher tax bracket in the future, the flexibility of having tax-free assets can still be valuable. Making annual contributions does add up over time. But often a more powerful way people maximize Roth assets is through conversions of existing pre-tax IRAs. Because taxable income is created when converting, this strategy is typically done in years of lower income such as being in between jobs, the first years of starting a new business or in the first years of retirement after earned income has stopped.

Notably the other plans described later in this piece (Simple and SEP IRAs) do not have Roth options.

Taxable Brokerage Accounts

Small business owners often want and need flexibility. A taxable brokerage account could be the way to achieve that and still invest for the future. A brokerage account can be owned in several ways such as individually, jointly as a couple or even titled to a trust.

The drawback to taxable accounts is they are (unsurprisingly) tax inefficient. Investments are purchased with after-tax dollars. Those investments will hopefully produce income over time in the form of interest, dividends and capital gains. This in turn becomes some form of taxable income to the owner for the year the income is received. Unlike a traditional IRA, the tax cannot be deferred to a future year.

There are, however, other advantages to a taxable account making them attractive despite the tax inefficiencies. Here are a few:

- Liquidity – Selling investments and accessing the proceeds typically has the fewest barriers in these accounts. While it can take some discipline not to abuse this privilege, you will not be penalized for making a withdrawal before reaching age 59 ½ unlike any of the other options discussed in this piece.

- Tax Loss Harvesting – If an investment has lost value since you purchased it, you have the option to sell it. That sale will result in a capital loss than can be used to offset any other capital gains. If you have more total capital losses than capital gains in a given year, you can even reduce your other ordinary income with those losses. You are limited to deducting $3,000 in net capital losses in a single year. Losses in excess of $3,000 can be carried forward and used in subsequent tax years.

- Borrowing Flexibility – You can borrow against the collateral in your taxable brokerage accounts. The most typical way is to turn your brokerage account into a margin account. Care must be taken to properly use a margin account. The key point here is that you can have a borrowing capability in a taxable account that is not available in an IRA.

Two – Savings Incentive Match Plan for Employees, a.k.a. Simple IRAs

A Simple IRA is often one of the first types of formal plans business owners put into place. It can be attractive choice if one or more of the following applies to you:

- Your small business has employees and you would like to provide them with additional benefits or incentives.

- You personally want to contribute more to your own retirement savings than what is allowed with a standard IRA.

- You want more tax efficiency for your investments than what you can achieve with a taxable brokerage account.

Employee Contributions

Using a Simple IRA can help provide a nice employee benefit. All of those participating in this plan (employer and employees) can each voluntarily make their own contributions. The contribution amount annually can be up to 100% of eligible compensation, but not to exceed $13,000 for 2019 (plus a catchup $3,000 for those age 50 or older).

Note you may make full contributions to both a Simple IRA and a traditional/Roth IRA but you may be subject to certain limits on the latter as noted earlier.

All contributions made to a Simple IRA are vested immediately. You cannot place any vesting restrictions on your employees. Also, the same distribution rules as a traditional IRA apply to a Simple IRA. But there is an additional limitation for Simple IRAs that discourage distributions within the first 2 years of participation because a 25% penalty would apply.

Employer Matching Contributions

As an employer, you must also choose one of these matching contribution methods below.

- 2% nonelective contribution – 2% of each eligible employee’s compensation regardless of whether or how much the employee deferred, or

- 3% matching contribution – match of employee’s elective deferrals on a dollar-for-dollar basis up to 3% of the employee’s compensation. You may reduce the 3% limit to a lower percentage, but never lower than 1%. You may not lower the 3% limit for more than 2 calendar years out of the 5-year period ending with the calendar year the reduction is effective.

How do you decide between the two contribution options? Based on your employee census (age and projected earnings) along with how likely you think employees would contribute to their own plans, you can estimate how much matching dollars would be required under either option.

One method may maximize your own contributions as employer. The other might better benefit your employees. It’s not necessarily mutually exclusive. Whatever you choose is also not set in stone. If you want to change the matching method in a future year, you may do so. You just need to make sure you notify employees during the election period.

Other Requirements for a Simple IRA

Here are a few other things to keep in mind when opening and operating a Simple IRA:

- Your company must have 100 or less employees and no other retirement plans in place.

- Execute a Written Agreement

- Send an Annual Notice to Employees

- Choose a financial institution and set up a Simple IRA for Each Eligible Employee

- Some timing requirements on when a plan can be established, but they are generally effective between Jan 1 and Oct 1.

- Costs can vary, but they are modest. There is likely an overall plan fee or some cost per participant.

For more details, you may refer to the IRS Simple IRA operating rules.

Three – Simplified Employee Pension Plan, a.k.a. SEP IRAs

The final plan we’ll look at is the SEP IRA. It can be attractive choice if one or more of the following applies to you:

- You would like to make higher contributions for yourselves than what is allowed in a Simple IRA.

- You would like more flexibility in making contributions.

- Typically, but not necessarily, you have fewer or no employees.

Employer Contributions

One key difference to the Simple IRA is that with a SEP IRA only the employer makes contributions. Elective salary deferrals and catchup contributions by employees are not allowed. Here are some notable points about SEP IRA contributions:

- Contribution Limits – Contributions an employer can make to an employee’s SEP-IRA cannot exceed the lesser of:

- 25% of the employee’s compensation, or

- $56,000 for 2019

- Special Computation for Your Own SEP IRA – When figuring the contribution for your own SEP-IRA, compensation is your net earnings from self-employment, less the following deductions:

- one-half of your self-employment tax and

- contributions to your own SEP-IRA.

- Flexibility in Contributions – You do not have to contribute every year. When you contribute, you must contribute to the SEP-IRAs of all participants who performed personal services during the year for which the contributions are made.

- Immediate Vesting – Employees are immediately vested in contributions made to their accounts.

Because of the stringent requirements to make proportional contributions to employees, a SEP IRA is often a better fit for small businesses with fewer to no employees. Of course, if your goal is to provide a benefit or incentive to employees, a SEP IRA can still be considered.

For higher income small business owners who anticipate being able to fully fund their own SEP accounts, the tax savings could be substantial enough to overcome (or at least tolerate) the requirement for employee contributions.

Other Requirements for a SEP IRA

Here are a few other things to keep in mind when opening and operating a SEP IRA:

- Execute a written agreement to provide benefits to all eligible employees.

- Give employees certain information about the agreement.

- Set up an IRA account for each employee.

- You can set up a SEP for a year as late as the due date (including extensions) of your business income tax return for the year you want to establish the plan.

For more details, you may refer to the IRS SEP IRA operating rules.

Comparing All Three Strategies

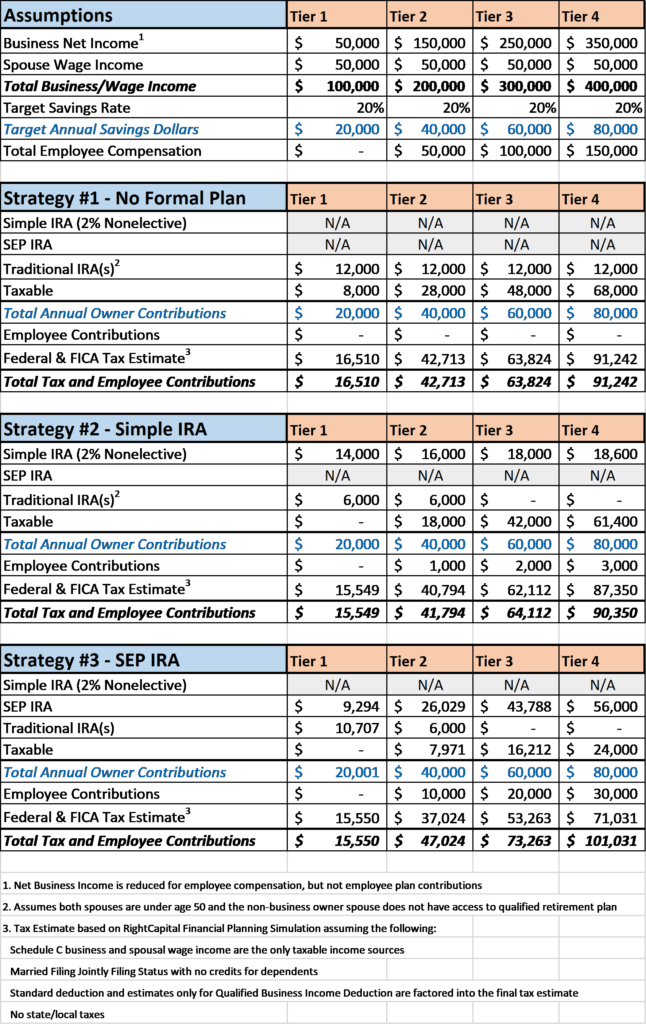

To bring all this together, we can look at some hypothetical households to compare the three strategies. For all the following scenarios, let’s assume:

- We have a married couple with both spouses under the age of 50

- One spouse is a business owner and the other spouse has $50,000 of employee wage income. We’ll look at varying income levels for the business owner.

- The couple’s goal is to save 20% of their combined pre-tax income annually. There is no mandate to have equal savings to accounts owned by each spouse.

- When using a formal retirement plan, they would like to maximize their own owner contributions and minimize contributions for employees.

- They would like to maximize any tax deferred savings first and then utilize taxable accounts if necessary. For simplicity, Roth IRAs are not used in these examples.

In the table below, we show four columns for different tiers of net business income ranging from $50,000 to $350,000. For every additional $100,000 in net business income, we also factor in one employee earning $50,000 in compensation.

Tier 1 Insights

In the first income tier, there are no employees assumed. The focus is simply on where money is saved and what is the tax impact. In this example, having no formal plan (Strategy #1) results in around $960 higher annual taxes than using either a Simple or SEP IRA (Strategy #2 or #3). In all three strategies, $20,000 is saved. But in the latter two strategies, an additional $8,000 of the savings is deferred from taxes at their 12% marginal tax bracket.

If this couple valued the ability to have that same $8,000 accessible in their taxable account, the current tax savings may not be very important. They might even consider using Roth IRAs instead of traditional IRAs if they expect their taxes to rise in the future or just prefer to build up their tax-free asset base. Basically, they are ways to justify NOT adopting a formal plan at this point.

Tier 2 Insights

At the second income tier, things become more interesting. With no formal plan, the most this couple can save on tax deferred basis is $12,000 ($6,000 in each’s spouses IRA), just like Tier 1. But now that the savings goal is $40,000, the difference of $28,000 is now assumed to be saved in a taxable account. Again, some of the flexibility previously discussed could make that valuable.

But if this couple were to adopt a Simple IRA they could save $22,000 on a tax deferred basis between the Simple and Traditional IRAs. They could also contribute $1,000 to a Simple plan for their one employee. It’s like giving that employee a 2% pay raise but NOT increasing out of pocket costs at the same time. Why? You’ll notice the combined tax and employee contributions is less than Strategy #1. As for Strategy #3 with the SEP IRA, the results are mixed. Your taxes would lower due to being able to contribute around $32,000 on a tax deferred basis, but the $10,000 required employee contribution makes the total costs nearly $5,000 higher.

Tier 3 Insights

In this tier, the couple’s target savings goal is $60,000. Adopting a Simple IRA allows them to pay roughly the same amount in total costs compared to not adopting a plan. But now they can contribute $1,000 to Simple plans for two employees. Using a SEP IRA is still the costliest way to go but could still be considered if incentivizing employees were important. $20,000 in total would be contributed for the employees, but total costs are “only” around $9,000 more than the Simple IRA strategy. The tax savings, aided by the $43,788 owner contribution, does help ease the burden.

Tier 4 Insights

In this final tier, it’s worth pointing out some things about the SEP IRA strategy. With a high earning business, the owner’s SEP contribution will get limited to $56,000. The potential problem is the corresponding high level of employee contributions needed. On one hand, that might be worth considering. After all, by having no formal plan in place at Tier 4, you’re only saving around $10,000 in total costs. Using the SEP IRA has $10,000 in higher costs, but now you’ve contributed $30,000 to your employees.

If your goal were to minimize employee contributions, you wouldn’t want to use the SEP. This is where you might start seriously looking at a more advanced retirement plan solution like a 401(k) plan. Like mentioned earlier, these have higher costs and administration. But they can be more flexibly structured to allow higher contributions for the business owner relative to the employees.

While not shown here, if you have a high earning business with no employees, such as a consulting business, the SEP IRA becomes the optimal choice among these simpler options. You can contribute up to $56,000 and not have any obligations to contribute to an employee.

Conclusion

In the end, choosing a “simple” retirement plan could help benefit your small business. Things worth doing usually take some effort and this is no exception. But I hope this piece gives you some insight into the moving pieces involved and what you need to consider before making your own decision.

References

- https://www.dol.gov/sites/dolgov/files/ebsa/about-ebsa/our-activities/resource-center/publications/401k-plans-for-small-businesses.pdf

- https://www.irs.gov/retirement-plans/choosing-a-retirement-plan-defined-benefit-plan

- https://www.irs.gov/publications/p590a#idm140115507766848

- https://www.irs.gov/publications/p590a#en_US_2018_publink1000230472

- https://www.irs.gov/publications/p590b#en_US_2018_publink1000231061

- https://www.irs.gov/retirement-plans/amount-of-roth-ira-contributions-that-you-can-make-for-2019

- https://www.irs.gov/publications/p590a#en_US_2018_publink1000230658

- https://www.investopedia.com/ask/answers/100314/whats-difference-between-cash-account-and-margin-account.asp

- https://www.irs.gov/retirement-plans/plan-participant-employee/who-can-participate-in-a-simple-ira-plan

- https://www.irs.gov/retirement-plans/operating-a-simple-ira-plan

- https://www.irs.gov/retirement-plans/plan-sponsor/simplified-employee-pension-plan-sep

The information on this site is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Krishna Wealth Planning LLC (referred to as “KWP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

KWP does not warrant that the information will be free from error. None of the information provided on this website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall KWP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the materials in this site, even if KWP or a KWP authorized representative has been advised of the possibility of such damages.

In no event shall KWP have any liability to you for damages, losses, and causes of action for accessing this site. Information on this website should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.