6-Minute Read

As we approach year end, it may be fitting to cover perhaps the most popular topic of discussion I’ve had with clients over the past couple of months.

That is the near risk-free, high return of the Series I Savings Bond. At the time of this writing, these “I Bonds” have an annualized rate of return of 7.12%!

Are I Bonds too good to be true? The short answer for now is no, but there are some caveats and limits. In this piece we’ll review some of the key things you need to know about this investment solution which can combine attractive returns and safety of principal in one package.

How I Bonds Work

Understanding the Interest Rate on I Bonds

To start, it’s important to know that the interest rate on I bonds is actually comprised of two parts: a fixed rate and an inflation rate. Add the two together and it forms a composite rate which is potentially the annualized rate you can expect to earn for owning such a bond.

At the time of this writing, the fixed rate on newly purchased I bonds is 0%. This fixed rate applies for the full life of the bond. That doesn’t sound great, right?

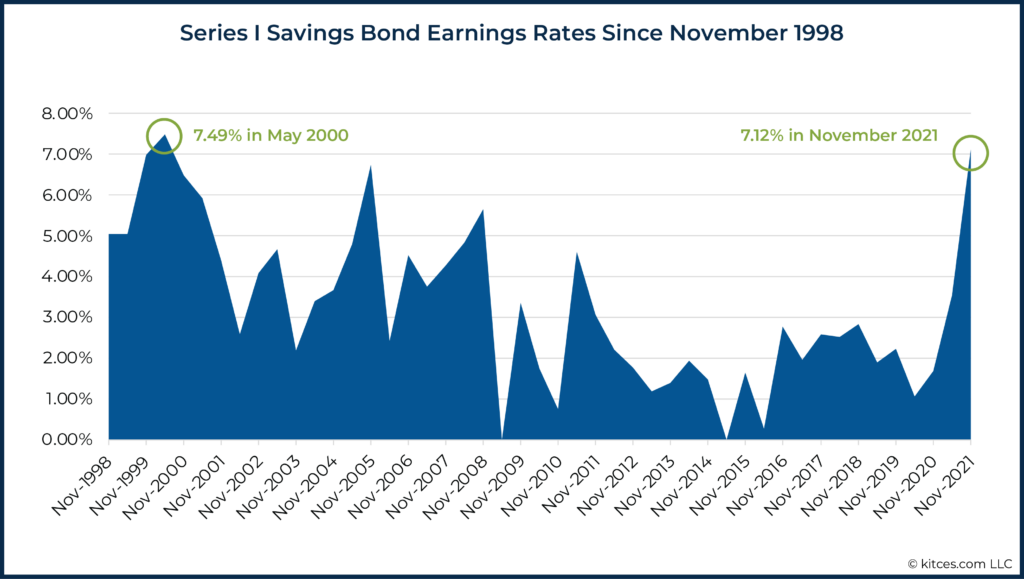

As teased in the introduction, the good news is that the inflation rate on newly purchased I bonds is 7.12%. This effectively makes the inflation rate and composite rate the same for now. We’ll note some caveats in the coming sections. But it’s worth pausing to reflect on such a high rate, regardless of the labels we give it. This telling chart below from the Kitces.com blog shows this is the highest earnings rate on I Bonds in over twenty years!

On one hand, this inflation rate is a result of the current spike in inflation that has been affecting the economy and likely your own purchases during the past year. But we’re not seeing a similar spike in rates on typical “safe” cash vehicles you might be using or considering. These include savings accounts, money market funds and CDs. You might be lucky to be get near a 0.50% rate now on these types of accounts.

Now there are ways to get a higher rate on certain types of fixed income investments. For example, you may have heard of things like junk bonds or peer-to-peer lending. Just realize you would be taking on what’s called a credit risk with these bonds. In search of a higher yield, you’re subjecting the principal you invest to a risk of loss. Sometimes that risk is substantial.

I Bonds, compared to many fixed income investments, have a relatively high potential rate of return for the risk. Because the principal invested is backed by the full faith and credit of the US government, that risk is essentially zero. Put another way, it’s basically the least risk available for any US dollar denominated investment product.

How Inflation Impacts the Rate on I Bonds

As I’ve noted earlier on this blog, it’s important to have a healthy fear of inflation. But in a strange way for I bond owners, you might embrace inflation.

For I bonds, the inflation rate component is variable and subject to change every 6 months. Specifically, the rate changes every May and November based on one of the key measures of the consumer price index (CPI-U).

So, this 7.12% rate noted earlier applies only to the first six months of a bond purchased now (December 2021). That equates to 3.56% for the first six months you own the bond. The rate you receive on the subsequent six months will not be known until May 2022.

It’s also worth noting inflation isn’t always positive. There can be periods of negative inflation which is also known as deflation. An attractive feature of I bonds is that the composite rate can never go below 0% even if the inflation rate goes negative.

How Much I Bonds Can You Purchase and How?

This is one of the caveats. Purchases of I Bonds are limited to $10,000 per individual per calendar year. A valid individual for this purpose is a citizen or resident of the US with a valid Social Security number.

Notably, a married couple could purchase up to $20,000 combined I bonds each calendar year. These bonds would be in electronic format. There is another exception that allows you to purchase an additional $5,000 each year in paper I bonds with your federal tax refund. More on that in the final section.

As far as how to purchase I Bonds, you can register and purchase them directly from the US Government’s TreasuryDirect website.

Can I Bonds Serve as your Emergency Reserve?

While it’s easy to appreciate that I bonds are backed by the US government, you might wonder whether these bonds should be used to replace your current emergency cash reserve. For example, you might want to have 6-months’ worth of living expenses available in cash. Again, this could be held at your bank in a savings account, money market or CD.

This is where you should keep in mind some of the holding restrictions:

- For the first year you own an I bond, you are simply not allowed to redeem it. There are limited exceptions to this strict rule such as the occurrence of a federally declared disaster.

- Another limitation is that if you redeem an I bond within the first five years of purchase, you must forfeit the last 3 months’ worth of interest.

- After five years, full redemptions are allowed. You also have the option to hold an I bond for a very long time as they have a 30-year maturity.

With these limitations in mind, it is still possible for I bonds to make up a portion of your emergency reserves. If your reserve target is large, it may take years to get there given the annual limits on purchases noted earlier. A true emergency reserve is something that is both safe and liquid. The general rule here is to not put money into an I bond that you expect to need within one year unless you have other resources you can tap.

Tax Treatment of I Bonds

As you might expect the interest from owning I bonds is considered taxable income. One good news is that the income is only subject to federal income taxes and not state income taxes.

As far as when to report the interest from I bonds, you can choose to simply report the interest every year. You also have the option to defer the reporting of interest until one of the following events occur:

- You cash the bond and receive what the bond is worth, including the interest, or

- You give up ownership of the bond and the bond is reissued, or

- The bond stops earning interest because it has reached final maturity

If you intend you use I bonds for funding your children’s college educations, you might even be able to exclude the reporting of interest from the bonds. There are certain requirements to follow, most notably having a low enough household income in the year of bond redemption and college funding.

Tips for Maximizing I Bond Purchases

There may be some of you who would like to maximize your purchases of I Bonds. Perhaps this is because of the combination of attractive current returns with minimal risk and reasonable limitations.

We already noted the $10,000 limit annually per person. But the annual part is based on calendar years. At the time of this writing (December 2021), this means you could individually buy $10,000 now and turn around again in January 2022 and buy another $10,000. In this example, both bonds would pay the 7.12% rate for the first six months.

If you’re thinking about family members, you can purchase them on behalf of each of your children (as well as other relatives). For children under 18, the account will need to be a custodian account linked to the parent’s TreasuryDirect account.

If you own or oversee a certain type of entity, you may be able to purchase I bonds in the entity’s name that won’t necessarily be counted against your individual purchasing limit. We won’t cover details here, but these entities could be corporations, partnerships, trusts and estates. The bonds purchased for a business may be limited to electronic format only.

This leads to some final points about paper I bonds:

- You’re allowed to purchase up to $5,000 per year in paper I bonds. You must be entitled to a federal refund, so this does take some careful planning to ensure you’ve paid in enough estimated tax payments or have had sufficient tax withheld.

- There are some special filing requirements, like including Form 8888 in your tax return to properly allocate the refund.

- The $5,000 limit is per tax return, which is not necessarily per individual like the electronic I bond requirement.

- You may not be comfortable with the risk of holding a paper I bond that could be lost or destroyed. Fortunately, you may use SmartExchange to make a paper to electronic conversion.

I hope that was helpful! If you have comments or questions on this piece, please drop me a line at: [email protected]

References

- https://www.kitces.com/blog/federal-series-i-savings-bonds-inflation-712-composite-rate-treasurydirect-compare-fixed-income-investments/

- https://krishnawealth.com/having-a-healthy-fear-of-inflation/

- https://www.treasurydirect.gov/indiv/research/indepth/ibonds/res_ibonds_ibuy.htm

- https://www.treasurydirect.gov/indiv/research/indepth/ibonds/res_ibonds_itaxconsider.htm#report

- https://www.treasurydirect.gov/indiv/planning/plan_education.htm

- https://www.irs.gov/pub/irs-pdf/f8888.pdf

- https://www.treasurydirect.gov/indiv/research/indepth/smartexchangeinfo.htm

The information on this site is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Krishna Wealth Planning LLC (referred to as “KWP”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

KWP does not warrant that the information will be free from error. None of the information provided on this website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall KWP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the materials in this site, even if KWP or a KWP authorized representative has been advised of the possibility of such damages.

In no event shall KWP have any liability to you for damages, losses, and causes of action for accessing this site. Information on this website should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.